How to Market Your New York Dispensary Against an Army of Illicit Shops

How to Market Your New York Dispensary Against an Army of Illicit Shops

Insights | 2025-09-30

Eric Allred - Head of Product

You didn't survive New York's CAURD lottery and eight-month buildout to fade into irrelevance.

The morning you cut the ribbon on your dispensary, you had every reason to celebrate. You'd cleared the Office of Cannabis Management's compliance gauntlet, secured one of the hardest-to-finance leases in America, and stocked shelves with products you personally vetted.

Your store looked perfect.

Three months in, you're watching something unsettling unfold.

A multi-state operator opens two blocks away with a million-dollar launch campaign and a celebrity investor doing Instagram stories from their grand opening. Your foot traffic doesn't disappear; it just never materializes the way you projected. Your budtenders are answering the same question repeatedly: "Wait, there's another dispensary on this block?"

This isn't about your product selection or your prices. You're facing a visibility problem in the most crowded emerging market in American cannabis.

New York's legal industry is projected to support around 1,700 licensed retailers in the long term, but only 363 had opened by April 2025. By mid-2025, approximately 436 adult-use dispensaries were operating, with hundreds more licenses already issued and awaiting their turn. In a market this compressed, obscurity is a death sentence.

The dispensaries that capture market share in New York aren't necessarily the ones with a fat old war chest.

They're the operators who treat marketing as an integral part of their infrastructure, not an afterthought. They understand that the Office of Cannabis Management's advertising restrictions don't limit creativity; they reward precision. They build systems that turn compliance into a competitive advantage.

This guide will show you how to cut through New York's noise, navigate some of the nation's strictest cannabis advertising regulations, and build a marketing plan tailored specifically to the state's unique competitive pressures and regulatory landscape.

Because in the city that never sleeps, your customers need to know you exist before they can choose you.

Key Takeaways

- Master New York's MRTA advertising restrictions to identify compliance gaps that become competitive advantages.

- Build marketing systems that drive visibility and customer acquisition in a market where obscurity is fatal.

- Partner with top New York brands, such as Dank, Ayrloom, and Jaunty, to leverage their consumer demand and access co-marketing support.

- Understand New York's layered tax structure: 13% excise, 9% wholesale, and up to 4% local, and use pricing transparency as a trust-building tool.

- Tie marketing spend to store-level KPIs like Marketing Efficiency Ratio, Cost Per Order, and loyalty opt-in rates.

- Use educational content and local storytelling to compete against MSO budgets and convert customers from the illicit market.

Understanding the New York Cannabis Marketing Landscape

Working Within New York’s Regulatory Framework

The Marihuana Regulation & Taxation Act (MRTA) legalized adult‑use cannabis in New York in March 2021. The state's rollout has been deliberately slow and equity‑focused. The Office of Cannabis Management (OCM) issued over 5,200 licenses and provisional permits across cultivation, processing, distribution, and retail categories by the end of 2024, with more than 54% of these awards going to social-equity applicants. Yet only 363 dispensaries were operating statewide by April 20, 2025, reflecting long buildouts and litigation delays.

New York’s advertising restrictions shape your strategy

New York licensees are subject to strict advertising guidelines. The OCM's marketing and advertising guidance requires evidence that at least 90% of an advertisement's audience is reasonably expected to be 21 years or older. Ads cannot be placed within 500 ft of schools or community facilities, and marketing must avoid bright neon colors, cartoons, or child‑like fonts. Digital campaigns must include age-gating and cannot utilize pop-up ads or unsolicited SMS messages. Sponsorships are permitted only if the audience meets the 90% threshold. These restrictions require dispensaries to invest in compliant digital platforms and carefully vet their advertising partners.

BioTrack and the upcoming Metrc transition

New York currently uses BioTrack as its seed‑to‑sale tracking system. Every gram of cannabis must be traced from cultivation to point‑of‑sale, and your marketing must align with what's available in BioTrack so promotions never advertise out‑of‑stock products. The OCM recently announced that New York will transition to Metrc by early 2026. Dispensaries should select technology vendors (such as POS, CRM, and e-commerce platforms) that can integrate with both systems to ensure a smooth transition and maintain compliance when the switch occurs.

Tax implications influence customer perception

Premium pricing is baked into New York's tax code. Retailers pay a 13 % excise tax at the point of sale, a 9 % wholesale excise tax, and up to 4 % in local taxes. Customers see these taxes on receipts, which contribute to New York's high average price per item (over $32 for a gram of flower as of mid‑2025). Transparent price communication, explaining how taxes fund social equity grants and enforcement, and offering value-driven bundles can help mitigate sticker shock.

Competitive Landscape in New York

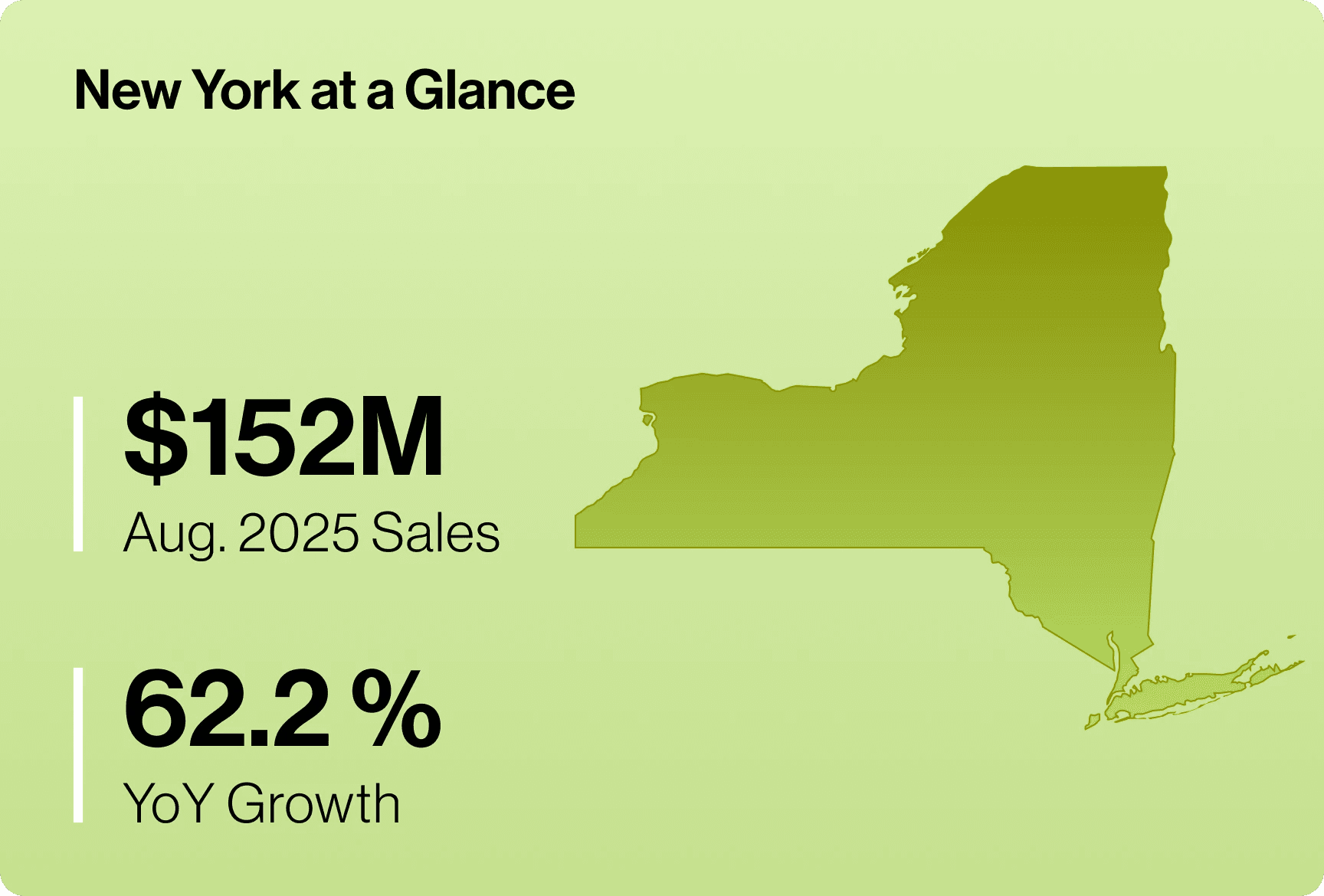

New York's cannabis market appears paradoxical: it boasts enormous potential, yet its rollout has been deliberately throttled. By July 2025, there were approximately 436 operational adult-use dispensaries across the state; however, regulators estimate that the market can support around 1,700 stores. Nearly 575 licensees had not yet opened, and more than 960 applications were under review. This gap between licenses issued and doors opened creates an unusual dynamic; competition is fierce in specific neighborhoods while entire regions remain underserved.

Price compression versus premium pricing

New York's limited retail footprint and high taxes keep average prices elevated. The average number of flower grams sold was approximately $14.84, and eighths were sold for $36.98 in August 2025. Yet, as more retailers open, price pressure is expected to increase. Operators must balance premium positioning with promotions that drive volume, especially as illicit shops, which still number more than 1,400 in New York City alone, undercut legal prices.

Regional disparities create opportunity

Upstate New York had 149 open dispensaries serving about 8.4 million people by the end of 2024, while Downstate (including New York City and Long Island) had only 111 open retailers for 11.2 million residents. Many rural regions, such as Long Island, the Finger Lakes, and the Mohawk Valley, have few or no stores. Independent operators willing to open in underserved areas can capture significant market share and build community relationships before large chains expand.

Brand partnerships provide an in‑market advantage

As the New York market matures, a handful of brands are already commanding consumer attention. According to the OCM's 2024 report, the top five selling brands —Dank, Ayrloom, Jaunty, Off Hours, and MFNY —account for 21% of statewide sales. Securing exclusive drops or co-marketing campaigns with these brands can drive foot traffic and differentiate your menu offerings. Because the majority of dispensary licenses are held by Social and Economic Equity (SEE) applicants, independent retailers may have access to unique products produced by equity‑owned cultivators and processors.

Consumer Trends & Preferences in New York

Understanding New York shoppers requires looking beyond national averages. Legal sales totaled roughly $1 billion in 2024, of which $758 million came from adult‑use sales. Analysts project sales will reach $2.8 billion by 2025. Yet per‑resident spending remains low—under $50 per person—indicating significant growth potential as the illicit market transitions to regulated outlets and new consumers enter the category.

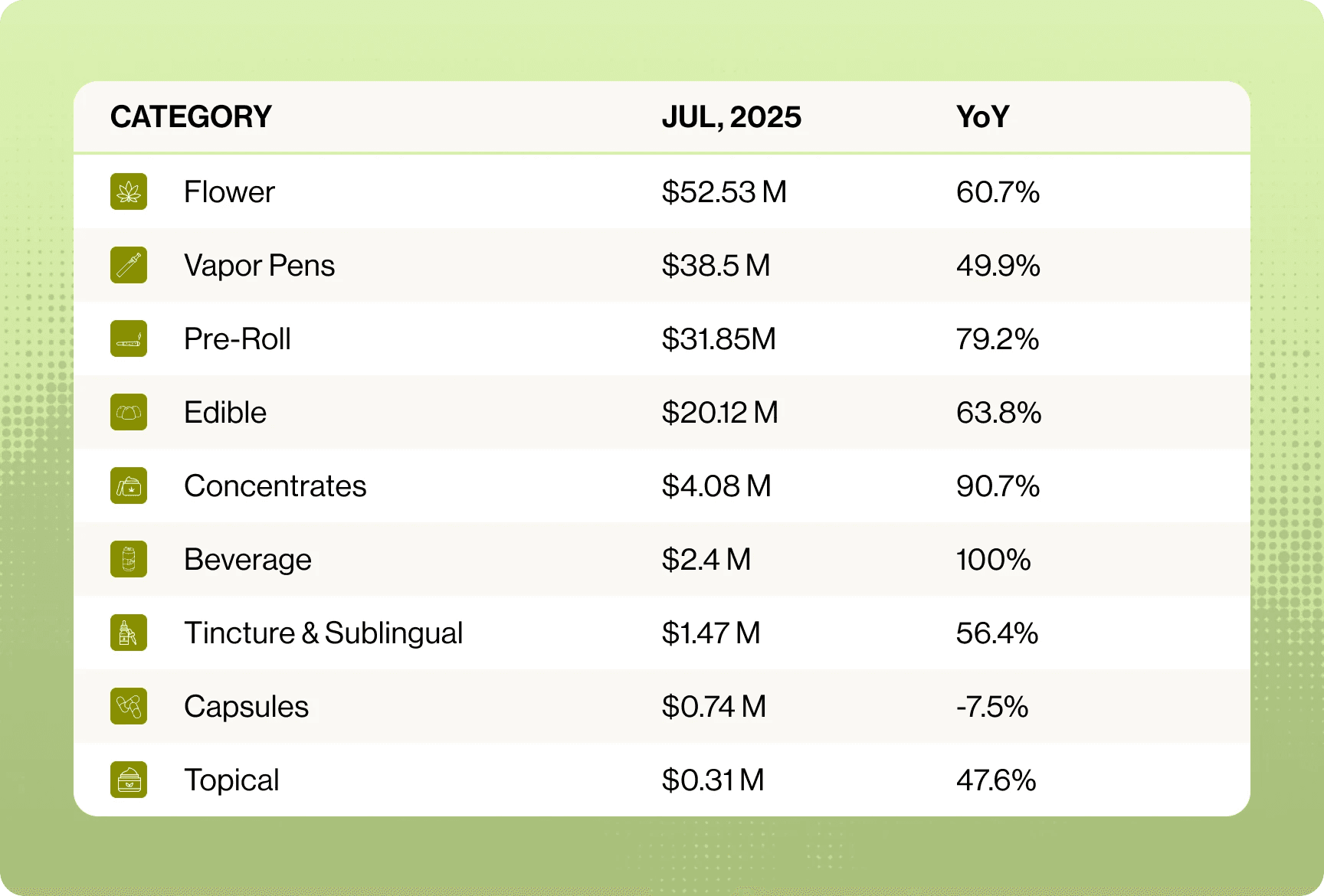

Category trends reveal evolving consumption patterns

Flowers remain New York's largest product category, with a 35% market share and approximately $31 million in sales in February 2025. Vaporizer cartridges hold 27 % share ($25 million), and pre‑rolls capture 17 % share ($16 million), reflecting the popularity of convenient, shareable formats. The high share for pre‑rolls suggests that consumers value ready‑to‑smoke options over loose flower. Beverages and edibles remain small but rapidly growing niches, particularly among new consumers seeking discrete experiences.

Demographic diversity drives personalization

Headset and OCM data show that Millennials and Gen Z drive the majority of purchases. Still, older adults are increasingly entering the market as retailers educate them on dosage and product types. Over 500 brands sell products in New York, and no single strain accounts for more than 2 % of total flower sales. This diversity demands segmented marketing: Gen Z shoppers may respond to digital loyalty programs and social content, while older adults might prefer educational events and personalized budtender recommendations.

Brand loyalty exists but must be nurtured

With hundreds of brands vying for attention, loyalty hinges on consistent quality, community engagement, and educational content. Stores that host terpene tastings, "meet the grower" events, or partner with local artists can create experiences that foster emotional connections and repeat visits. New York's strict advertising rules mean your in‑store experience and owned channels (website, SMS, and email) are critical for storytelling.

Competitive Landscape in New York

New York's cannabis market appears paradoxical: it boasts enormous potential, yet its rollout has been deliberately throttled. By July 2025, there were approximately 436 operational adult-use dispensaries across the state; however, regulators estimate that the market can support around 1,700 stores. Nearly 575 licensees had not yet opened, and more than 960 applications were under review. This gap between licenses issued and doors opened creates an unusual dynamic; competition is fierce in specific neighborhoods while entire regions remain underserved.

Price compression versus premium pricing

New York's limited retail footprint and high taxes keep average prices elevated. The average number of flower grams sold was approximately $14.84, and eighths were sold for $36.98 in August 2025. Yet, as more retailers open, price pressure is expected to increase. Operators must balance premium positioning with promotions that drive volume, especially as illicit shops, which still number more than 1,400 in New York City alone, undercut legal prices.

Regional disparities create opportunity

Upstate New York had 149 open dispensaries serving about 8.4 million people by the end of 2024, while Downstate (including New York City and Long Island) had only 111 open retailers for 11.2 million residents. Many rural regions, such as Long Island, the Finger Lakes, and the Mohawk Valley, have few or no stores. Independent operators willing to open in underserved areas can capture significant market share and build community relationships before large chains expand.

Brand partnerships provide an in‑market advantage

As the New York market matures, a handful of brands are already commanding consumer attention. According to the OCM's 2024 report, the top five selling brands —Dank, Ayrloom, Jaunty, Off Hours, and MFNY —account for 21% of statewide sales. Securing exclusive drops or co-marketing campaigns with these brands can drive foot traffic and differentiate your menu offerings. Because the majority of dispensary licenses are held by Social and Economic Equity (SEE) applicants, independent retailers may have access to unique products produced by equity‑owned cultivators and processors.

Consumer Trends & Preferences in New York

Understanding New York shoppers requires looking beyond national averages. Legal sales totaled roughly $1 billion in 2024, of which $758 million came from adult‑use sales. Analysts project sales will reach $2.8 billion by 2025. Yet per‑resident spending remains low—under $50 per person—indicating significant growth potential as the illicit market transitions to regulated outlets and new consumers enter the category.

Category trends reveal evolving consumption patterns

Flowers remain New York's largest product category, with a 35% market share and approximately $31 million in sales in February 2025. Vaporizer cartridges hold 27 % share ($25 million), and pre‑rolls capture 17 % share ($16 million), reflecting the popularity of convenient, shareable formats. The high share for pre‑rolls suggests that consumers value ready‑to‑smoke options over loose flower. Beverages and edibles remain small but rapidly growing niches, particularly among new consumers seeking discrete experiences.

Demographic diversity drives personalization

Headset and OCM data show that Millennials and Gen Z drive the majority of purchases. Still, older adults are increasingly entering the market as retailers educate them on dosage and product types. Over 500 brands sell products in New York, and no single strain accounts for more than 2 % of total flower sales. This diversity demands segmented marketing: Gen Z shoppers may respond to digital loyalty programs and social content, while older adults might prefer educational events and personalized budtender recommendations.

Brand loyalty exists but must be nurtured

With hundreds of brands vying for attention, loyalty hinges on consistent quality, community engagement, and educational content. Stores that host terpene tastings, "meet the grower" events, or partner with local artists can create experiences that foster emotional connections and repeat visits. New York's strict advertising rules mean your in‑store experience and owned channels (website, SMS, and email) are critical for storytelling.

Building Your New York Cannabis Marketing Plan

An effective marketing plan links business goals to measurable outcomes. Most dispensary marketing efforts fail not because of poor tactics but because they skip the foundational work. Establishing clear objectives and accountability frameworks ensures that every dollar spent drives meaningful results.

Setting Clear Objectives & Dispensary KPIs

Your marketing success depends on tracking the right metrics and understanding how they connect to your bottom line. We developed BNCHMRK, a dataset of key dispensary KPIs, to assist owners, operators, and marketing leaders in better understanding the efficacy of their marketing efforts by looking at a confluence of store-level, order-level, and loyalty-based metrics.

The nine key KPIs connect marketing activities with the income statement and help govern channel-related activity. By leveraging our proprietary BNCHMRK dataset, you can develop an understanding of how various channel-specific KPIs collectively contribute to broader, overall order—and store-level performance.

Store-Level Metrics

Store-level metrics focus on overall business health and performance:

- Marketing Efficiency Ratio (MER): Measures total revenue generated per marketing dollar spent.

- Acquisition Marketing Efficiency Ratio (aMER): Evaluates revenue specifically attributable to new customer acquisition relative to marketing spend.

Order-Level Metrics

Order-level metrics analyze individual customer transactions:

- Cost Per Order (CPO): Tracks marketing spend efficiency per transaction.

- Customer Return Rate: Highlights the proportion of customers making repeat purchases, indicating marketing's effectiveness in driving ongoing customer engagement.

Loyalty & Retention Metrics

Loyalty-based metrics evaluate customer retention and long-term value:

- Customer Review Rate: Indicates the percentage of customers leaving reviews, reflecting engagement and satisfaction.

- New Customer Review Rate: Specifically measures engagement among new customers.

- Loyalty Program Opt-In Rate: Measures how effectively customers enroll in loyalty programs.

- New Customer Loyalty Opt-In: Evaluates initial engagement by new customers with loyalty programs.

- Marketing Opt-In Rate: Assesses the success of customer consent to marketing communications, highlighting potential for ongoing relationship building.

Budgeting & Resource Allocation

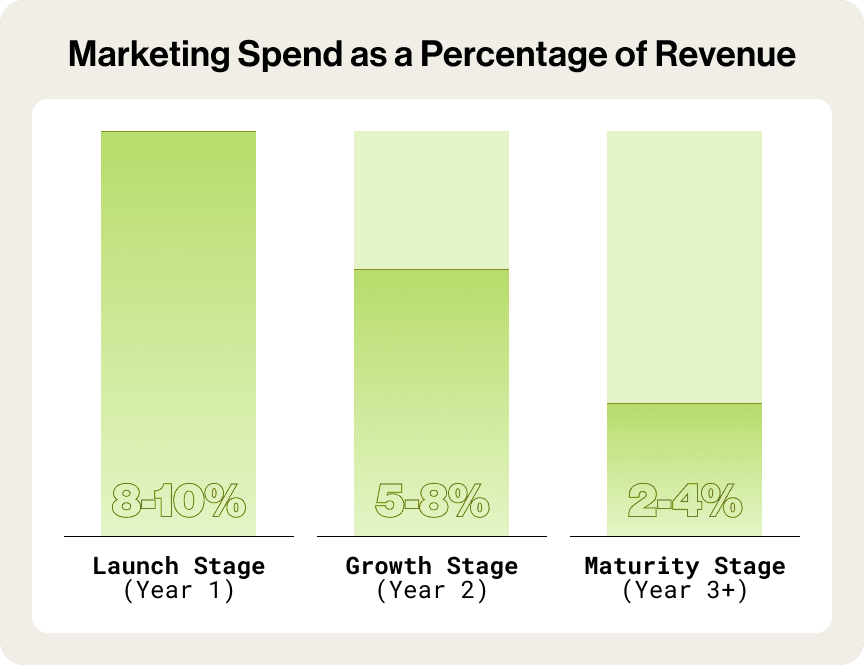

Your marketing budget should reflect your dispensary's business stage, competitive landscape, and specific business objectives. Aligning your marketing spend with clear KPIs keeps marketing activities accountable and maximizes the marginal contribution of each marketing dollar spent.

Creating Your Dispensary's Marketing Budget

Creating an adequate marketing budget requires assessing three key factors:

- Business Stage: Are you launching, growing, or mature?

- Market Competitiveness: Is your dispensary in a densely competitive urban area or a more rural, less competitive market?

- Revenue Levels: Established dispensaries allocate around 1–2% of topline revenue to marketing. Newer dispensaries or those in competitive markets may need to allocate more.

Allocating Your Budget

Strategically distribute your budget to balance foundational growth with targeted expansion:Foundational Channels

- Website & SEO (30–40%): Optimize for local searches, ensure intuitive navigation, and prioritize mobile responsiveness.

- Email & SMS Marketing (15–20%): Build an engaged subscriber list to drive repeat visits through personalized communication.

- Local Awareness (15–20%): Invest in local events, promotions, and community engagement.

Growth Channels

- Paid Advertising: Introduce targeted paid search, social media ads, and cannabis-specific platforms incrementally, scaling based on results.

- Loyalty & Retention: Expand loyalty programs, personalized incentives, and referral campaigns for high-ROI customer retention.

Budget Variations by Stage

Launch Stage (Year 1)

Marketing Spend: 8–10% of revenue

Focus on foundational efforts: website setup, SEO, initial customer acquisition, and establishing local brand presence.

Growth Stage (Year 2)

Marketing Spend: 5–8% of revenue

Expand paid advertising, increase SEO efforts, enhance content creation, and prioritize loyalty and retention programs.

Maturity Stage (Year 3+)

Marketing Spend: 2–4% of revenue

Refine loyalty initiatives, selectively leverage paid advertising, and focus on maximizing customer lifetime value.

Aligning your marketing budget to your dispensary's lifecycle and market realities ensures sustainable growth, optimized ROI, and lasting success.

Choosing Technology Vendors That Power Marketing Success

Your technology's interoperability determines your marketing execution capabilities and adherence to compliance. In New York's tightly regulated environment, selecting the right POS system, CRM platform, and supporting tools creates the foundation for scalable, compliant marketing operations. With the state's impending transition from BioTrack to Metrc, selecting systems capable of dual integration is no longer optional.

Selecting Your Online Menu & POS System

Your POS system should seamlessly integrate real-time inventory across in-store terminals, online menus, and third-party marketplaces, such as Leafly and Weedmaps. Maintaining accurate product availability across these customer touchpoints prevents "out-of-stock" disappointments and builds consumer trust that displayed products are actually available for purchase.A modern POS should also provide detailed analytics on purchase history, best-selling products, and peak shopping times, enabling you to make more informed marketing decisions. Platforms like Dutchie, Treez, and Blaze offer robust analytics and marketing integrations explicitly designed for cannabis retail operations.

Choosing a Cannabis-Focused CRM

Beyond transaction processing, you need systems that understand cannabis consumer behavior patterns. Cannabis-focused CRMs, such as Springbig, Alpine IQ, and Happy Cabbage, enable customer segmentation based on purchase recency, frequency, and monetary value, while supporting multi-channel communication across email, push notifications, SMS, and loyalty programs that comply with New York's strict advertising guidelines.Integrating loyalty programs and automated rewards ensures you continuously incentivize repeat purchases, build retention, and recognize high-value customers—critical advantages when competing against MSO budgets and the illicit market.

Integration & Compliance

Select vendors that interact seamlessly. Real-time synchronization between POS, CRM, and your online menu platforms ensures accuracy across customer touchpoints. Built-in seed-to-sale integration (supporting both BioTrack and the upcoming Metrc transition), automated age verification, and tax calculation features reduce administrative burden while keeping your operations aligned with OCM requirements.

Implementing Your Dispensary Marketing Strategy

- Successful dispensary marketing meets customers at every touchpoint with messaging that guides them from awareness to loyalty. Individual channels must excel independently while reinforcing a unified brand experience that compounds results.

Website Design & Development – Your Digital Storefront

- Make a strong first impression: Consumers form opinions in seconds. A polished, professional design builds trust and converts visitors into customers.

- Prioritize mobile: Over 70 % of cannabis consumers browse dispensary menus on mobile devices. Fast load times, intuitive navigation, and mobile‑friendly ordering are non-negotiables.

- Serve as a trusted guide: Integrate real‑time inventory, comprehensive product information, and educational content so your site functions as your best salesperson.

- Streamline the user journey: Use simple navigation, clear calls‑to‑action and minimal friction to help shoppers quickly find what they need.

Local SEO – How New Yorkers Find You

- Be visible when it matters: Most cannabis shoppers visit a store within 24 hours of an online search. Ranking in the top three local results on Google directly translates into increased foot traffic.

- Optimize your Google Business Profile: Populate your listing with accurate information, including hours, menus, photos, and regular updates. Encourage happy customers to leave reviews; frequent positive reviews boost rankings and trust.

- Create local content: Publish blog posts and videos that highlight New York cannabis culture, neighborhood events, and education about legal products to capture “dispensary near me” searches.

Email & SMS Marketing – Bringing Back Regulars

- Grow your list: Use in‑store signage and online pop‑ups to encourage email and SMS opt‑ins. Compliant opt‑in language and double‑age verification are essential in New York.

- Segment to personalize: Group subscribers by purchase history, product preference, and recency. Personalized messaging consistently outperforms generic blasts and keeps your brand top‑of‑mind.

- Automate engagement: Set up welcome series, re‑engagement campaigns, and birthday promotions to nurture relationships at scale while maintaining a personal feel.

- Stay compliant: Select platforms that offer built-in age verification and a straightforward opt-out process, aligning with OCM guidelines.

Paid Advertising – Amplifying Your Reach

- Diversify channels: Combine digital ads (Google, programmatic, cannabis‑friendly networks) with community sponsorships and local events. Multi‑channel campaigns generate higher engagement than single‑channel efforts.

- Target responsibly: Use geo‑targeting, demographic filters and interest‑based targeting to ensure at least 90 % of your audience is 21 or older and to avoid areas near schools and community centers.

- Partner with community organizations: Sponsoring events that align with your values builds goodwill, increases brand visibility, and helps meet the 90 % audience requirement.

- Track and refine: Use unique phone numbers, discount codes, and landing pages to measure ad performance accurately. Continuously shift budget toward high‑performing segments.

New York Dispensary Marketing FAQs

Can dispensaries advertise in New York?

Yes, within strict parameters. New York allows advertising across digital, print, and event channels, but campaigns must ensure that at least 90% of the audience is over 21. They cannot be placed within 500 feet of schools or community facilities and must avoid cartoons, neon colors, and any content attractive to minors. All ads must include specific health warnings and cannot make false or misleading medical claims.

Are dispensaries in New York profitable?

Profitability varies widely. Premium prices and limited competition have enabled strong margins for some early entrants, but high taxes, compliance costs, and the ongoing presence of unlicensed shops squeeze profitability. Operators that manage costs, build loyal customer bases, and leverage data‑driven marketing are more likely to achieve sustainable profits.

How much does a dispensary owner in New York make?

Earnings depend on location, operating efficiency, and scale. Because no individual or entity may own more than three retail dispensary licenses and retail licensees cannot hold cultivation, processing, or distribution licenses, growth often requires expanding to underserved regions or adding value through ancillary services. Owners who optimize inventory, build brand partnerships, and invest in customer education tend to see higher returns.

What are the biggest challenges for New York dispensaries?

Slow licensing, municipal opt‑outs, and an entrenched illicit market are significant hurdles. The limited number of open stores has led to product shortages and high prices, while thousands of illegal shops compete without paying taxes or complying with safety standards. Navigating compliance, securing capital for buildouts, and attracting talent in a nascent industry also present challenges.

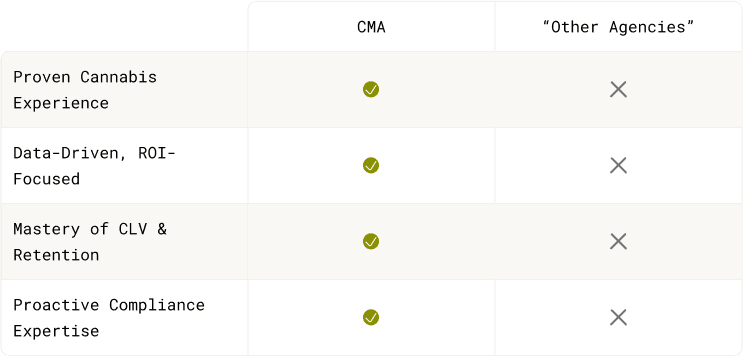

Working with Cannabis Marketing Experts

- Most marketing agencies struggle to deliver results for New York dispensaries because they lack an understanding of the nuances that make cannabis retail fundamentally different from other industries. The state's evolving regulatory framework, intense market competition, and distinct consumer demographics demand expertise that goes far beyond traditional marketing playbooks.

When evaluating a New York Cannabis Marketing Agency, keep these critical factors in mind.

- Prioritize cannabis expertise: Ensure your agency understands MRTA regulations and OCM guidance better than you do, including age‑gating, advertising restrictions, and track‑and‑trace requirements.

- Demand data‑driven strategies: Agencies should focus on KPIs tied to revenue and provide case studies of success in similar markets.

- Seek cultural alignment: Successful campaigns feel authentic to New York’s diverse communities. Partner with marketers who appreciate local culture, social equity considerations, and the nuances of each borough or region.

- Verify compliance processes: Your agency should have built‑in compliance checks that prevent violations rather than reacting to them after the fact.

Moving Forward with Marketing Your New York Dispensary

New York's cannabis market rewards dispensaries that move beyond planning and take decisive, strategic action.

Success requires a systematic marketing approach that builds authentic customer relationships, drives consistent transactions, and establishes long-term profitability amid an evolving regulatory landscape and emerging competition.

Start with the fundamentals.

Clear objectives, appropriate technology selection, and integrated marketing across channels create the foundation for sustainable growth.Success comes from consistent execution rather than perfect planning, so start with one channel, optimize its performance, and gradually expand your marketing efforts.

Identify your biggest opportunity.

Your primary marketing challenge likely falls into one of three categories: establishing credibility in a market still educating consumers about legal cannabis, converting online interest into in-store visits, or building the repeat purchase behavior that separates profitable dispensaries from struggling ones.Identifying your challenge helps prioritize activities and create measurement frameworks that track progress.

Build adaptable, data-driven systems.

Dispensaries that create flexible, data-driven marketing systems are able to successfully adapt to changing regulations, evolving technologies, and shifting consumer preferences. The New York market rewards operators who use data to inform their decisions, rather than relying on intuition or copying competitors.Whether you're navigating customer acquisition costs, retention challenges, or competition from well-funded operators, the solution remains consistent: strategic planning, systematic execution, and relentless focus on the customer experience.New York's equity-focused licensing framework and gradual market expansion create exceptional opportunities for independent operators who establish strong market positions before national chains dominate the landscape.

The opportunity is here. It’s time to take action.

About The Cannabis Marketing Agency

The Cannabis Marketing Agency: Cannabis marketing experts making your dispensary the one everyone talks about (in a good way).

We make your dispensary the local favorite — the spot people talk about, shop at, and keep coming back to.

+4 Years Growing Dispensaries: We don't "learn on your dime".

Trusted by Dispensaries in 18 Markets: From Cali to Mass, if it’s legal, we’ll help you win.

For DIYers who hate learning the hard way.

Want More Dispensary Customers?

We grow dispensaries like it’s our day job (because it is). Ever wonder what we’d do for yours? Let’s find out.

Get Started