Marketing an Oregon Dispensary Through The Pricing Wars

Marketing an Oregon Dispensary Through The Pricing Wars

Insights | 2025-12-03

Eric Allred - Head of Product

Imagine this: You've survived Oregon's OLCC licensing maze. You've secured one of the rare retail permits now worth six figures because the state won’t issue more. You created a cozy space with reclaimed wood and Edison bulbs. You sourced flower from skilled cultivators in Southern Oregon and hired budtenders who can discuss terpene profiles.

Opening day comes and goes. Then week two. Month three. Month six.Cars slow by your entrance, then speed off to the Nectar store three blocks away. Your carefully chosen selection—small-batch flower at $8 per gram, artisanal edibles, solventless concentrates—remains untouched. Meanwhile, the chain down the street sells $3.75-per-gram flower by the pound, with a full parking lot.

Sound familiar?

Here’s the issue: It’s not about product quality. You have better flower. It’s not about pricing either—you’re competing at margins unsustainable outside Oregon’s oversupplied market.

You have a visibility problem.

Oregon's cannabis market is a paradox of legacy. The state legalized early, allowing operators to operate freely through vertical integration. It issued licenses generously, creating opportunity and chaos. Approximately 800 licensed dispensaries now compete for customers in a state with a population of 4.2 million. That’s 16.8 dispensaries per 100,000 residents—one of the highest ratios in the nation.

Meanwhile, growers produced 12.3 million pounds of cannabis in 2024, far more than Oregon’s market can consume. Wholesale prices plummeted, and retail prices followed. The median price per gram fell from $10.50 in 2016 to $3.75 by 2024. Monthly retail sales have declined year-over-year since 2021.

Being open isn’t the same as being found.

From our work with dispensaries nationwide, we’ve spotted a trend. The ones thriving in oversaturated, price-compressed markets like Oregon aren’t always the biggest or best-funded. They know marketing isn’t just about being loud; it’s about being visible when customers are searching. They build loyalty that goes beyond price and create unique offerings that large chains can’t replicate.

Oregon's cannabis market is mature, oversupplied, and unforgiving. However, it rewards operators who execute their strategies effectively. Let's get that fresh, tasty bud flying off your shelves.

Key Takeaways

- Master Oregon's oversupply dynamics to identify pricing and volume opportunities that vertically integrated chains overlook.

- Build marketing systems that drive basket size and customer lifetime value in a price-compressed, declining sales environment.

- Understand Oregon's liberal advertising framework and strict enforcement standards to maximize visibility while avoiding violations.

- Create geographic advantages by capitalizing on border market dynamics and tourist corridor opportunities.

- Develop measurement frameworks connecting marketing activities to transaction value, retention rates, and business outcomes.

- Focus on Oregon's sophisticated consumer culture, characterized by organic cultivation, sustainability, and craft quality, to build authentic local differentiation.

Understanding the Oregon Cannabis Marketing Landscape

Oregon's Regulatory Framework

Oregon voters legalized recreational cannabis in 2014, making it one of the first states with an adult-use market. The Oregon Liquor & Cannabis Commission (OLCC) runs the program. It issues separate licenses for producers, processors, wholesalers, retailers, and labs.Oregon allows vertical integration, unlike Washington. A single company can hold production, processing, and retail licenses. This gives firms control over the entire supply chain. It benefits those who integrated early while hurting those who couldn't.

As of 2024, Oregon has about:

- 1,375 producer licenses

- 288 processor licenses

- 257 wholesaler licenses

- 789 retail licenses

- 13 testing laboratories

These numbers don't tell the whole story. License moratoriums make it nearly impossible to get new permits. Now, entering Oregon's cannabis market means buying an existing license, which can cost six figures on the secondary market.These limits create a protective barrier for current license holders. Each month the moratorium lasts, your competitive edge grows. New entrants face capital needs and regulatory hurdles that you didn’t have when you joined the market.

Oregon's advertising freedoms create competitive advantages.

Oregon allows cannabis advertising in ways not permitted in states like Illinois or New York. This includes outdoor ads, digital displays, and print media. However, the OLCC (via OAR 845-025-8040) strictly enforces content rules. Violating these can lead to license suspension or revocation.

You can use various advertising channels, but you must follow strict content guidelines. Avoid deceptive claims, cartoon characters, targeting youth, showing consumption, mentioning health benefits, or encouraging out-of-state transport. All ads must include mandatory warnings: "Do not operate a vehicle," "For use only by adults 21+," and "Keep out of reach of children." Also, you need to confirm that your audience is mostly 21 or older.

Local municipalities may add more restrictions. These can include minimum spacing between dispensaries, bans on advertising within 1,000 feet of schools, and stricter signage rules. Understanding compliance helps build trust with customers who have many options.

Oregon's tax structure influences customer perception and competitive positioning.

Oregon has a 17% state excise tax on recreational cannabis, plus up to 3% in local taxes, depending on the area. Unlike most states, Oregon has no general sales tax; therefore, the excise tax is the only additional charge on customer receipts.

This creates a strategic advantage. Oregon's total tax burden (17-20%) is significantly lower than that of Washington (37%), Illinois (30% or more), or California (30% or more). Clear pricing communication is crucial for dispensaries near state borders. However, visible excise taxes also show the price gap between legal and illegal cannabis.

Competitive Landscape in Oregon

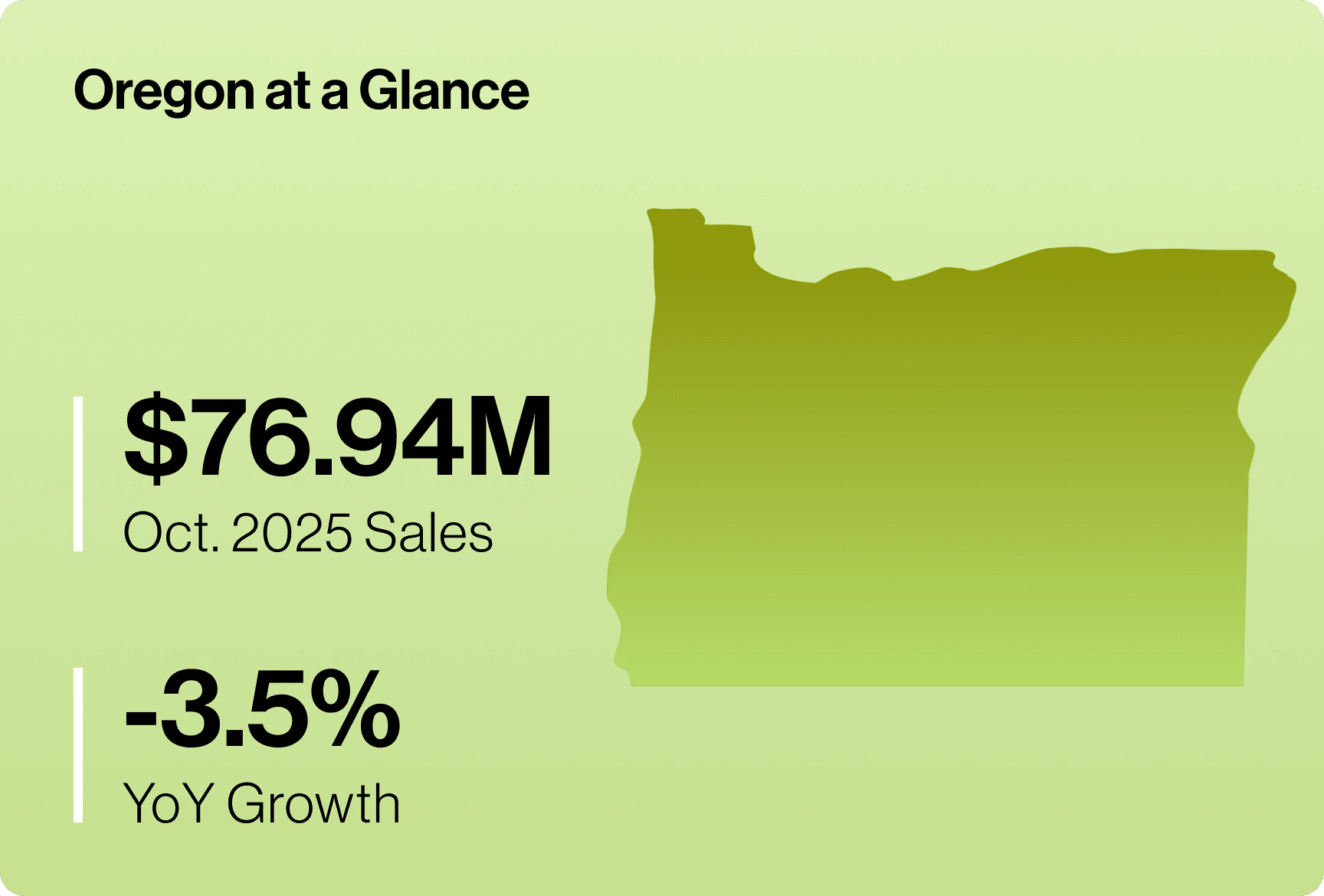

Oregon's cannabis market can seem daunting at first.With about 800 licensed dispensaries for 4.2 million people, it has one of the highest dispensary-per-capita ratios in the U.S. Annual recreational sales peaked at $1.18 billion in 2021 but dropped to $955 million in 2023, with monthly sales around $78 million by mid-2025. Growers produced an estimated 12.3 million pounds of cannabis in 2024, far more than the legal market can handle. This led to a collapse in wholesale prices, squeezed retail margins, and consolidation that benefits well-funded operators.

Yet, this view overlooks key opportunities.

Vertical integration creates vulnerabilities.

Several chains dominate Oregon’s retail scene through cultivation-to-retail integration: Nectar (40+ locations), Chalice (15 dispensaries), La Mota (value pricing), Electric Lettuce (Portland-focused), and Oregon's Finest (premium offerings). These operators control much of the market by selling their own flower at lower prices, cutting out wholesale margins.

However, vertical integration can lead to inflexibility. Large operators streamline their operations across many locations. This often sacrifices local ties—they standardize products, store experiences, and marketing. They struggle to adapt, host community events, or build genuine relationships that turn visitors into regulars.

That’s where you can gain an edge.

Geographic opportunities reward strategic positioning.

Oregon's geography offers unique opportunity zones. Border counties like Malheur (next to Idaho, which bans recreational cannabis) generate $20.25 in per-capita sales compared to $2.46 in other counties; Ontario alone has 13 dispensaries for 11,000 residents. Similar chances exist along the California border and near popular destinations (coast, ski resorts, wine country). Urban density in Portland boosts competition and total sales, while underserved rural markets create monopolies for operators willing to serve smaller towns.

Brand partnerships accelerate credibility.

Oregon consumers trust local brands like Wyld (top edibles), Select (leading vape cartridges), Oregrown (organic flower), and East Fork Cultivars (craft cultivation). Partnering with these brands can enhance consumer recognition, provide co-marketing opportunities, and ensure product quality that new dispensaries struggle to match, speeding up customer acquisition in a crowded market.

Consumer Trends and Preferences in Oregon

To truly understand Oregon's cannabis consumer, we need to look beyond price sensitivity and see the core values shaping their choices.

Oregon's consumers prioritize sustainability, transparency, and quality over just low prices. The state's diverse demographics give birth to various customer types that require a personalized marketing approach.

Generational segmentation reveals distinct priorities.

Millennials (ages 28-43) make up about 49% of purchases, spending the most on concentrates and embracing new consumption methods. They respond well to digital marketing and loyalty programs. Gen X (ages 44-59) accounts for 39% of sales, dividing spending between concentrates and vape pens, with more female buyers and less price sensitivity. Boomers (ages 60+) are a growing segment, favoring vape pens and pre-rolls, seeking wellness benefits, and valuing education from knowledgeable staff.

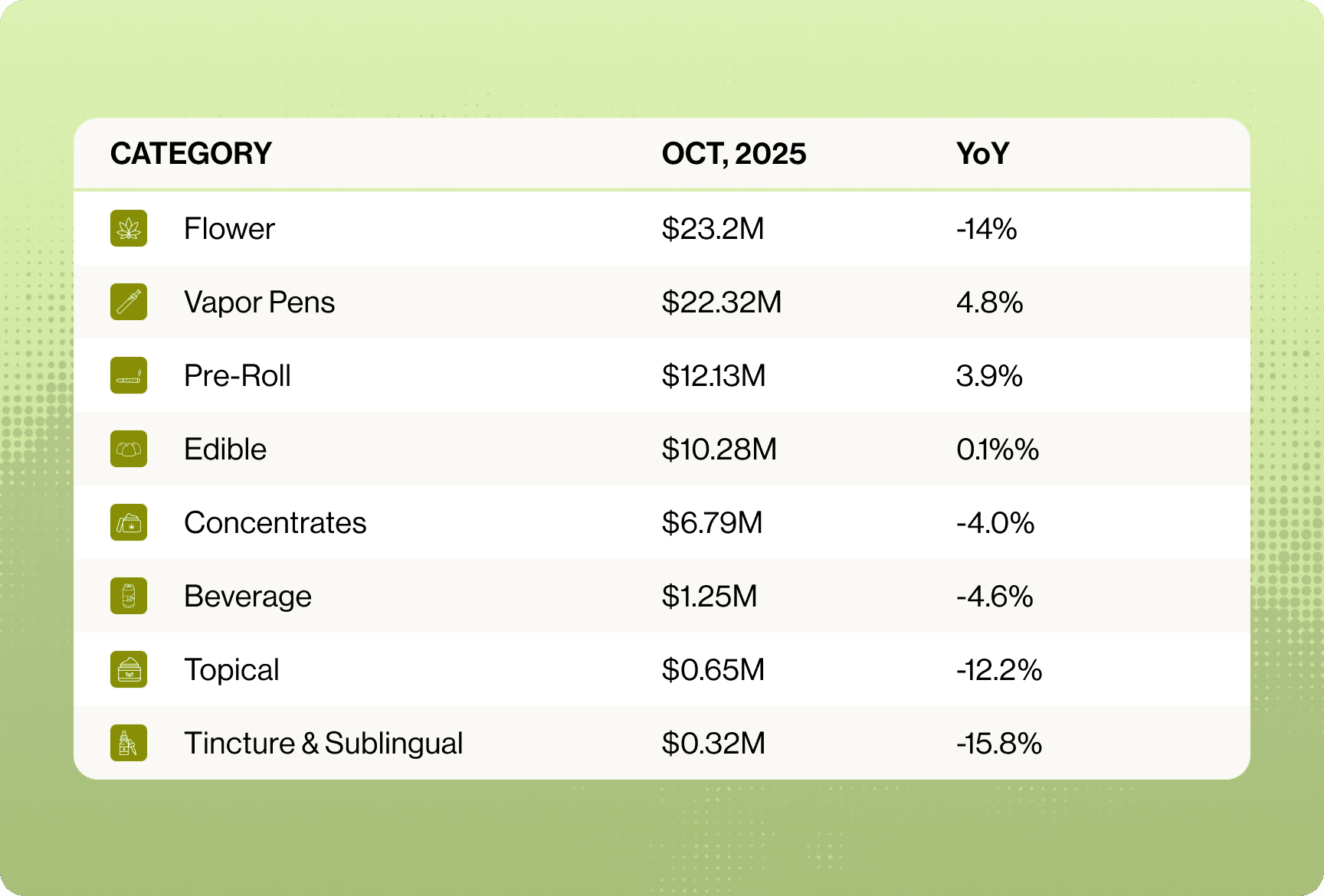

Category trends reveal evolving consumption patterns.

While flower remains the top choice, consumers are branching out. Concentrates are gaining traction, especially solventless rosin and live resin, attracting those seeking potency and flavor. Pre-rolls and infused pre-rolls are the fastest-growing category, offering convenience and novelty. Edibles face fierce competition, with gummies, chocolates, and beverages; consumers expect consistent dosing and natural ingredients. Topicals and wellness products appeal to Boomers and others seeking therapeutic benefits without intoxication.

Cultural values drive purchasing decisions.

Oregon's cannabis culture prioritizes sustainability (organic practices, sun-grown flower), transparency (clear supply chains, lab testing), quality over price (willingness to pay for superior products), local and craft (Oregon-grown products are valued), and education (understanding terpenes, strain genetics). Dispensaries that educate rather than just sell foster loyalty that withstands price pressures.

Building Your Oregon Cannabis Marketing Plan

Oregon's competitive intensity demands precision. Vague goals like "increase sales" or "get more customers" don't generate actionable insights.

Establishing clear objectives and measurement frameworks allows us to hold dispensary marketing accountable and create a framework for prioritization. This allows us to focus our limited time and resources on the channels that are making a difference.

Setting Clear Objectives & Dispensary KPIs

Your marketing success depends on tracking the right metrics and understanding how they connect to your bottom line. We developed BNCHMRK, a dataset of key dispensary KPIs, to assist owners, operators, and marketing leaders in better understanding the efficacy of their marketing efforts by looking at a confluence of store-level, order-level, and loyalty-based metrics.

The nine key KPIs connect marketing activities with the income statement and help govern channel-related activity. By leveraging our proprietary BNCHMRK dataset, you can develop an understanding of how various channel-specific KPIs collectively contribute to broader, overall order—and store-level performance.

Store-Level Metrics

Store-level metrics focus on overall business health and performance:

- Marketing Efficiency Ratio (MER): Measures total revenue generated per marketing dollar spent.

- Acquisition Marketing Efficiency Ratio (aMER): Evaluates revenue specifically attributable to new customer acquisition relative to marketing spend.

Order-Level Metrics

Order-level metrics analyze individual customer transactions:

- Cost Per Order (CPO): Tracks marketing spend efficiency per transaction.

- Customer Return Rate: Highlights the proportion of customers making repeat purchases, indicating marketing's effectiveness in driving ongoing customer engagement.

Loyalty & Retention Metrics

Loyalty-based metrics evaluate customer retention and long-term value:

- Customer Review Rate: Indicates the percentage of customers leaving reviews, reflecting engagement and satisfaction.

- New Customer Review Rate: Specifically measures engagement among new customers.

- Loyalty Program Opt-In Rate: Measures how effectively customers enroll in loyalty programs.

- New Customer Loyalty Opt-In: Evaluates initial engagement by new customers with loyalty programs.

- Marketing Opt-In Rate: Assesses the success of customer consent to marketing communications, highlighting potential for ongoing relationship building.

Budgeting & Resource Allocation

Your marketing budget should reflect your dispensary's stage in business, its competitive landscape, and specific business objectives. Aligning your marketing spend with clear KPIs keeps marketing activities accountable and maximizes the marginal contribution of each marketing dollar spent.

Creating Your Dispensary's Marketing Budget

Creating an adequate marketing budget requires assessing three key factors:

- Business Stage: Are you launching, growing, or mature?

- Market Competitiveness: Is your dispensary in a densely competitive urban area or a more rural, less competitive market?

- Revenue Levels: Established dispensaries allocate around 1–2% of topline revenue to marketing. Newer dispensaries or those in competitive markets may need to allocate more.

Allocating Your Budget

Strategically distribute your budget to balance foundational growth with targeted expansion:

Foundational Channels

- Website & SEO (30–40%): Optimize for local searches, ensure intuitive navigation, and prioritize mobile responsiveness.

- Email & SMS Marketing (15–20%): Build an engaged subscriber list to drive repeat visits through personalized communication.

- Local Awareness (15–20%): Invest in local events, promotions, and community engagement.

Growth Channels

- Paid Advertising: Introduce targeted paid search, social media ads, and cannabis-specific platforms incrementally, scaling based on results.

- Loyalty & Retention: Expand loyalty programs, personalized incentives, and referral campaigns for high-ROI customer retention.

Budget Variations by Stage

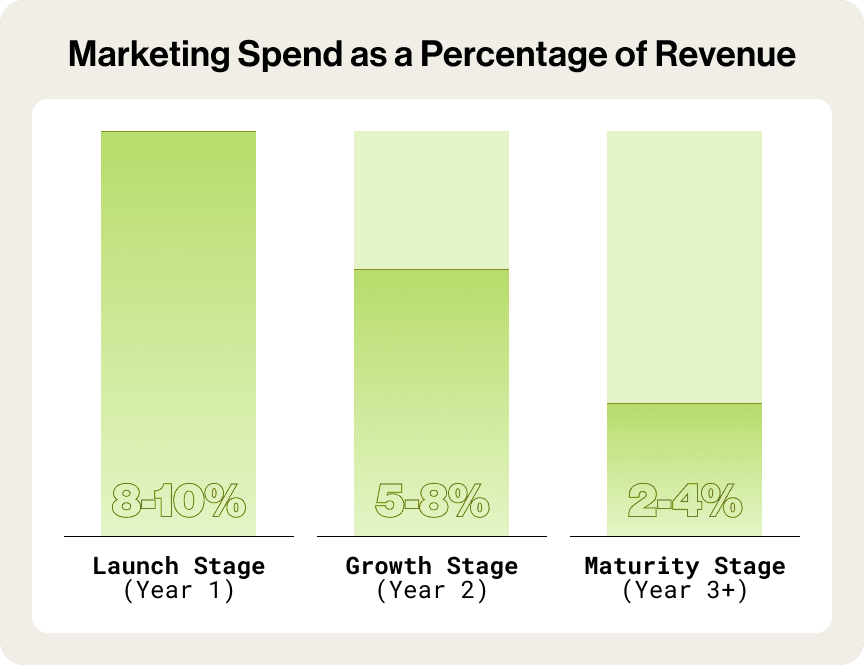

Launch Stage (Year 1)

Marketing Spend: 8–10% of revenue

Focus on foundational efforts: website setup, SEO, initial customer acquisition, and establishing local brand presence.

Growth Stage (Year 2)

Marketing Spend: 5–8% of revenue

Expand paid advertising, increase SEO efforts, enhance content creation, and prioritize loyalty and retention programs.

Maturity Stage (Year 3+)

Marketing Spend: 2–4% of revenue

Refine loyalty initiatives, selectively leverage paid advertising, and focus on maximizing customer lifetime value. Aligning your marketing budget to your dispensary’s lifecycle and market realities ensures sustainable growth, optimized ROI, and lasting success.

Choosing Technology Vendors That Power Marketing Success

Your technology's interoperability determines your marketing execution capabilities and compliance adherence. Selecting the right POS system, CRM platform, and supporting tools creates the foundation for scalable, compliant, integrated marketing operations.

Choosing Your Online Menu & POS System

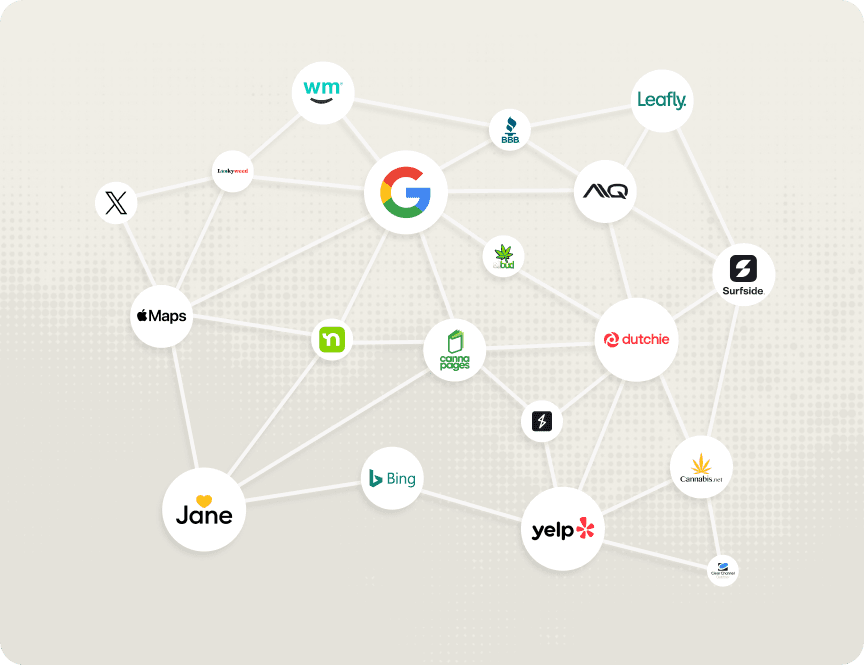

Your POS system should seamlessly integrate real-time inventory across in-store terminals, online menus, and third-party marketplaces (Leafly, Weedmaps). Maintaining accurate product availability across customer touchpoints prevents "out-of-stock" disappointments and fosters consumer trust that displayed inventory accurately reflects what's actually available.

A modern POS should provide granular analytics on purchase history, best-selling products, peak shopping times, and sales by product category, brand, and budtender—giving you data for intelligent marketing decisions and automatic compliance with Oregon's Metrc tracking system. As an Agency Plus partner, we are biased, and for good reason, towards Dutchie. Other strong options include Jane, Treez, and Flowhub depending on your operational needs.

Selecting a Cannabis-Focused CRM

Beyond transaction processing, you need systems that understand cannabis consumer behavior patterns. Cannabis-focused CRMs like Springbig, Alpine IQ, or Happy Cabbage enable customer segmentation by purchase recency, frequency, and monetary value while supporting multi-channel communication across email, SMS, push notifications, and loyalty programs.

In Oregon's competitive market with 800+ dispensaries, your CRM must enable precise segmentation and personalization. Generic mass messaging wastes budget and damages brand perception among Oregon's sophisticated consumers who expect authentic, relevant communication.

Integration and Compliance Requirements

Select vendors that interact seamlessly. Real-time synchronization between POS, CRM, loyalty platforms, and Metrc tracking ensures accuracy across customer touchpoints while maintaining compliance. Built-in age verification, automated consent management, and audit trails for all customer communications reduce administrative burden while keeping your operations compliant with Oregon's regulatory requirements.

Technology that doesn't integrate creates liability and wastes opportunities.

Implementing Your Dispensary Marketing Strategy

Effective dispensary marketing requires orchestrating multiple channels to create seamless customer experiences that drive acquisition, conversion, and retention. Success (and profit) comes from optimizing each channel individually while ensuring they work cohesively.

Website Design & Development – Your Digital Storefront

- First impressions drive trust: Most consumers form opinions about your dispensary within seconds, and a strong design instantly converts visitors into customers.

- Mobile optimization matters: Over 70% of cannabis customers browse dispensary websites via mobile; fast-loading, seamless mobile experiences significantly boost conversions.

- Serve as a trusted guide: Your website should integrate real-time inventory, robust product details, and educational content, positioning your dispensary as your top salesperson.

- Optimized user journey: Minimize friction and help consumers find what they want when they want through intuitive navigation, accurate inventory updates, and clear calls to action.

Local SEO – How Customers Find You

- Visibility at the right moment: Most cannabis consumers visit dispensaries within 24 hours of an online search; ranking at the top locally translates to traffic, foot traffic, and ultimately sales.

- Optimized Google profiles: Information-rich, regularly maintained Google Business Profiles will attract more visitors and foster more consumer trust than standard listings.

- Reviews matter: Frequent positive online reviews improve search rankings and build credibility. Solicit feedback and respond professionally to demonstrate your commitment to customer satisfaction.

- Local content connects: Create and promote localized content highlighting local cannabis culture, events, and community involvement to capture "dispensary near me" searches.

Email & SMS Marketing – Bringing Back Regulars

- Turn visitors into subscribers: Incentivizing email and SMS sign-ups builds your list, a long-term asset, and significantly contributes to repeat visits and increases customer lifetime value.

- Segmentation drives sales: Group customers by purchase habits and preferences to personalize marketing and deliver personalized, relevant communications that outperform generic messaging.

- Automate to scale engagement: Maintain personal touchpoints through automated welcome series, re-engagement campaigns, and birthday rewards.

- Compliance handled seamlessly: Focus on customer relationships by leveraging marketing platforms with built-in age verification and regulatory compliance.

Paid Advertising – Amplifying Your Reach

- Multi-channel impact: Integrate campaigns across digital ads, community sponsorships, and local events to deliver substantially higher engagement than single-channel strategies.

- Target strategically: Use geographic, demographic, and behavioral targeting to reach compliant adult audiences.

- Community partnerships amplify reach: Collaborate with local organizations and events to expand your advertising influence.

- Track to optimize: Implement unique tracking methods, such as dedicated phone numbers and custom landing pages, to measure advertising effectiveness and continually refine your marketing spend.

Oregon Dispensary Marketing FAQs

Can dispensaries advertise in Oregon?

Yes, Oregon permits cannabis advertising across multiple channels—including digital display, out-of-home, print, and community sponsorships—making it one of the more permissive cannabis advertising environments nationally. However, all advertisements must include mandatory warnings ("Do not operate a vehicle," "For use only by adults 21+," "Keep out of reach of children"), document predominantly 21+ audiences, and avoid prohibited content like cartoon imagery, consumption depictions, health claims, or minor targeting.Major platforms like Google, Facebook, and Instagram still prohibit paid cannabis advertising regardless of state law, requiring Oregon dispensaries to leverage cannabis-friendly programmatic networks, Weedmaps, Leafly, out-of-home advertising, and organic social media. Oregon's relatively permissive environment creates competitive advantage for operators who understand compliant, effective advertising.

Are dispensaries in Oregon profitable?

Oregon dispensaries can achieve profitability despite oversupply, price compression, and declining sales, but success requires strategic differentiation and operational excellence. The median price per gram dropped to $3.75 (from $10.50 in 2016), while average transactions hover around $12.31. Monthly retail sales declined from over $100 million in 2021 to $78 million in 2025.Profitability depends on several factors: vertically integrated operators like Nectar and Chalice eliminate wholesale margins and achieve profitability at lower retail prices; border-county dispensaries capture out-of-state customers and generate significantly higher per-capita sales; operators who build customer loyalty and increase lifetime value sustain margins even with low transaction values; and lean operations with optimized labor scheduling and strategic product mix enable sustainable profitability.Oregon's challenging economics reward operators who execute well while forcing less sophisticated operators toward consolidation or market exit.

How much does an Oregon dispensary owner make?

Owner income varies dramatically based on business model, location, and operational efficiency. Independent single-location dispensaries in competitive markets might generate $35,000-$80,000 in annual take-home profit after expenses, while border-county or underserved rural markets can generate significantly higher returns. Multi-location operators with 3-5 locations can generate $150,000-$300,000+ through economies of scale, and vertically integrated chains controlling cultivation, processing, and retail generate substantially higher returns through margin capture across the supply chain.However, many Oregon dispensaries operate at break-even or loss. Owner income depends entirely on ability to differentiate, control costs, build customer loyalty, and optimize marketing efficiency in a price-compressed environment.

How do Oregon's prices compare to other markets?

Oregon maintains some of the lowest cannabis prices nationally, with a median retail price of $3.75 per gram—significantly below those in Washington ($6-8), California ($8-12), Illinois ($12-15), and Massachusetts ($14-18). Average transaction values follow a similar pattern: Oregon's $12.31 is well below the national average of $45-$ 65.These low prices create challenges for operators competing on margin, but opportunities for border-county dispensaries capturing customers from neighboring states with higher prices or prohibition. The price differential particularly benefits dispensaries near Idaho (where complete prohibition is in effect) and Washington (where higher taxes and prices are in place).

What are the biggest challenges for Oregon dispensaries?

Oregon's market presents three interconnected challenges. First, extreme oversupply drives unsustainable economics: growers produce 12.3 million pounds annually while the market contracts (monthly sales declined from $100 million+ in 2021 to $78 million in 2025). Second, approximately 800 licensed dispensaries compete for customers in a state with a population of 4.2 million—one of the highest dispensary-to-population ratios nationally. Third, low average transactions ($12.31) require high customer frequency and strong retention to achieve profitability.Additionally, vertically integrated chains like Nectar and Chalice control the entire cultivation-to-retail process and can undercut independent operators on price while maintaining their margins. New market entrants face premium license acquisition costs while existing operators benefit from reduced competition.These challenges are real but reward operators who differentiate strategically, build customer loyalty, and execute with operational excellence.

Working with Cannabis Marketing Professionals

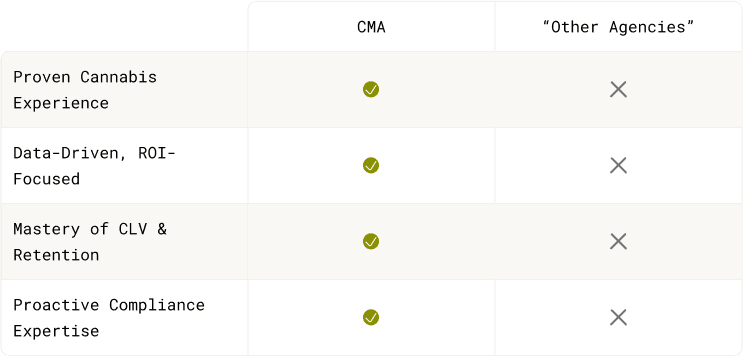

Building effective dispensary marketing in Oregon requires specialized knowledge that general marketing agencies lack. Oregon's unique combination of permissive advertising regulations, extreme price compression, oversupply dynamics, and sophisticated consumer demands requires expertise in cannabis-specific SEO, compliant advertising, retention marketing, and data analytics.

If you decide to work with an Oregon Cannabis Marketing Agency, here are a few things to remember:

- Prioritize proven cannabis experience. When evaluating potential partners, it’s essential to understand precisely what a cannabis marketing company does and whether it's worth the investment, ensuring you choose an agency aligned with your dispensary’s unique goals.

- Demand data-driven approaches. Your agency should focus on measurable results rather than vanity metrics, providing specific ROI examples and performance benchmarks from comparable dispensary clients. They should understand cannabis customer lifetime value, acquisition costs, and retention strategies specific to the industry.

- Ensure cultural alignment. Cultural alignment becomes crucial because cannabis marketing requires an authentic understanding of the community and customer mindset.

- Verify compliance processes. Comprehensive compliance processes should be built into every campaign and strategy. Your marketing agency should understand Illinois cannabis regulations better than you do, with systems and procedures that prevent violations before they occur rather than fixing problems after they happen.

Moving Forward with Marketing Your Oregon Dispensary

Oregon's cannabis market is brutal, oversupplied, and dominated by vertically integrated operators with advantages you cannot replicate. But it rewards strategic operators who understand that competition isn't about matching competitor prices, it's about creating value that transcends price.

The license moratorium provides temporary competitive relief. New dispensaries cannot enter the market. Your competitive set is fixed for now. Use this window to capture customers, build loyalty, and establish brand equity before the next wave of licenses eventually arrives.

Master the basics before attempting sophistication.

You must optimize your dispensary's Google Business Profile and establish a consistent review generation process. Your website must load within 3 seconds, function properly on mobile devices, and deliver educational value. Your email and SMS infrastructure must capture opt-ins and automate retention campaigns. These foundational elements drive discovery, conversion, and retention; everything else is amplification.

Identify your primary constraint.

Your biggest marketing challenge likely falls into one of three categories: building initial visibility in a market with 800 competing dispensaries, converting website traffic and walk-ins into transactions in a comparison-shopping environment, or turning one-time buyers into weekly regulars when the average transaction is only $12.31.

Identify your constraint, then allocate resources to solve it. Dispensaries struggling with visibility should invest heavily in local SEO and Google Business Profile optimization. Dispensaries with high traffic but low conversion rates should focus on budtender training, product education, and enhancing the in-store experience. Dispensaries with customers but poor retention should prioritize loyalty programs, personalized email marketing, and community engagement.

Build systems that increase customer lifetime value.

In Oregon's low-margin environment, customer lifetime value is a key determinant of profitability. To optimize this, track retention rates, purchase frequency, and average transaction value by customer segment. Use data to identify which customers generate profit and which cost more to acquire than they'll ever spend.

Optimize marketing spend toward high-value customer segments. Build loyalty programs that reward frequency and basket size. Create educational content that drives cross-category purchasing (flower buyers also purchase edibles and concentrates).

Oregon's cannabis market is mature, oversupplied, and price-compressed. The market rewards execution, not wishful thinking.

About The Cannabis Marketing Agency

The Cannabis Marketing Agency: Cannabis marketing experts making your dispensary the one everyone talks about (in a good way).

We make your dispensary the local favorite — the spot people talk about, shop at, and keep coming back to.

+4 Years Growing Dispensaries: We don't "learn on your dime".

Trusted by Dispensaries in 18 Markets: From Cali to Mass, if it’s legal, we’ll help you win.

For DIYers who hate learning the hard way.

Want More Dispensary Customers?

We grow dispensaries like it’s our day job (because it is). Ever wonder what we’d do for yours? Let’s find out.

Get Started