Maryland's $1B+ Cannabis Market is Growing. Market & Win It.

Maryland's $1B+ Cannabis Market is Growing. Market & Win It.

Insights | 2025-01-22

Eric Allred - Head of Product

The doors swing open. Congratulations are in order.

You've conquered the Maryland Cannabis Administration gauntlet, the applications, the compliance hoops, andthe social equity lottery odds. You've transformed your medical operation or built something entirely new. You've stocked the shelves with premium flower like RYTHM and SunMed, you've trained your staff, and the space feels right.

Opening day comes and goes. Then week two. Month three. Month six.

And something's wrong.

Cars slow down near your entrance, then accelerate past, heading toward the RISE location, which is two miles away. The gLeaf down the street has a line at 4 PM on Tuesdays. Zen Leaf's parking lot stays full on weekends. Meanwhile, your carefully selected inventory sits exactly where you placed it.

Sound familiar?

Here's what's happening: You don't have a product problem. You don't have a pricing problem. You have an invisibility problem.

Maryland's adult-use market exploded in July 2023 with nearly 100 converted medical dispensaries hitting the ground running. Today, over 100 retailers are competing for attention in a market that generated $806 million in 2024 and projects to reach $1.1 billion by 2025. Factor in Maryland's tax structure, constantly shifting regulations, and the reality of competing against both scrappy locals and deep-pocketed multi-state operators, and you're facing something most license holders didn't prepare for.

Being open isn't the same as being found.

After working with dispensaries across the country, we've noticed a pattern: The winners aren't always the ones with the most capital or the best locations. They're the ones who cracked the code on three key aspects: understanding who their customers actually are, accurately reading their local market, and building systems that define what winning looks like before they begin playing.

This guide walks you through Maryland's marketing compliance landscape, the core building blocks of an effective dispensary marketing plan, how to execute your strategy without burning cash, and how to create a measurement framework that turns guesswork into growth.

Key Takeaways

- Identify opportunities overlooked by larger chains by mastering Maryland's adult-use market dynamics and regulatory environment.

- Develop marketing systems that drive volume and loyalty as average item prices compress from $29.41 to $27.00.

- Partner with market-leading Maryland brands, such as SunMed Growers, Curio Wellness, and Rythm, to leverage existing consumer demand.

- Safeguard your business by understanding Maryland's tax structure, which rose from 9% to 12% in July 2025, and MCA compliance requirements.

- Create measurement frameworks that tie marketing activities to business outcomes and the income statement.

- Focus on community engagement and local differentiation to compete against multi-state operators.

Understanding the Maryland Cannabis Marketing Landscape

How Maryland Opened Its Doors to Adult-Use Cannabis

When Maryland residents cast their ballots in November 2022, they set the stage for a new chapter in cannabis policy. The Cannabis Reform Act, enacted in May 2023, created a pathway for licensed medical dispensaries to transition into the adult-use market, effective July 1, 2023. The response was immediate, $709 million in adult-use sales during the first year, driven mainly by these converted facilities. The state doubled down on opportunity through social equity lottery rounds in spring and summer 2024, awarding 205 conditional licenses spanning cultivation, processing, and retail operations. By mid-2025, the ecosystem had grown to approximately 174 active license holders: 103 dispensaries, 24 processors, and 20 cultivation operations. Unlike some jurisdictions, Maryland maintains a flexible licensing system; operators can focus on a single tier or build across multiple categories without being forced into vertical integration.

Understanding Maryland's Marketing Guardrails

Maryland gives cannabis businesses room to promote their products, but within clear boundaries designed to protect public health. The state's 2025 advertising framework draws a firm line against unsubstantiated health claims; clinical research must back any therapeutic or medicinal assertions. All promotional content must be truthful and aimed squarely at adults; anything that might attract minors, whether through cartoon imagery, misleading messages, or depictions of consumption, is off-limits. Physical advertising faces geographic constraints: regulators have restricted billboards and signage to on-premises locations, and no placements are permitted on government property or within a 500-foot buffer of schools and playgrounds. Digital and broadcast campaigns require demographic proof that at least 85% of viewers or listeners are of legal age. Even dispensary websites must implement age verification through date-of-birth entry, without harvesting visitor data until eligibility is confirmed.

The through-line in all these rules? Audience composition. Businesses need to demonstrate—and document—that their marketing reaches adult consumers, using reliable age-verification data across every channel.

Keeping Operations Transparent and Compliant

Maryland's regulatory philosophy emphasizes accountability from seed to sale. License holders must track every stage: from cultivation through processing, distribution, and final retail transaction. The focus on accountability means rigorous documentation protocols, standardized packaging and labeling, and secure handling throughout the supply chain. Although the Maryland Cannabis Administration has shifted away from exclusive reliance on Metrc, most operators synchronize their point-of-sale platforms with inventory management and digital menus to maintain real-time product data. This integration does more than satisfy regulators; it prevents the frustration of advertising unavailable items, preserves an audit trail, and strengthens customer confidence.

How Taxation Shapes the Market Experience

Taxes are a significant factor in how consumers perceive value and legitimacy in the state of Maryland. Adult-use purchases currently incur a 9% sales tax, which will increase to 12% on July 1, 2025. This increase, designed to bolster state finances, is projected to boost quarterly tax collections by more than the $18 million captured in Q2 2025. Medical patients continue to enjoy full tax exemption. Revenue flows into targeted buckets: county coffers, the Maryland Cannabis Public Health Fund, the Cannabis Business Assistance Fund, which supports minority- and women-owned enterprises, and the Community Reinvestment and Repair Fund. When dispensaries break down pricing to show precisely where tax dollars go, it transforms a potential pain point into a story about community investment.

Maryland's tax rates remain competitive compared to some neighboring markets, yet pricing pressure persists. The MCA's fiscal 2025 analysis showed that the average per-gram cost declined from $10.86 in 2020 to $9.21 by early 2024, with further decreases anticipated. Still, adult-use cannabis in Maryland typically commands premium pricing, a reflection of constrained supply, comprehensive testing requirements, and robust consumer demand.

Maryland's Competitive Cannabis Environment

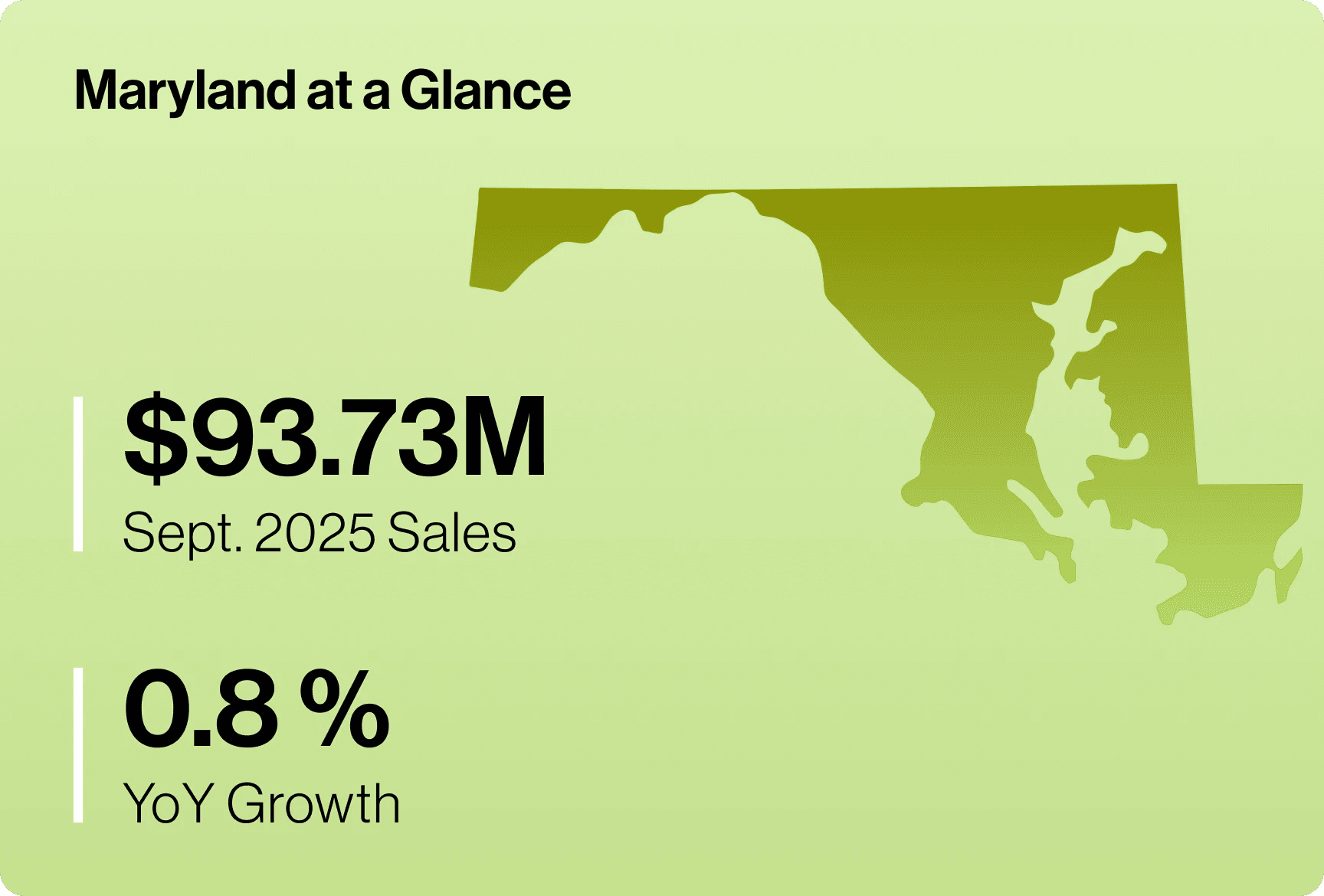

At over 100 licensed dispensaries vying for market share, Maryland's cannabis sector presents a crowded but opportunity-rich landscape. The state logged $806 million in adult-use revenue during 2024, with combined medical and recreational sales approaching $1.14 billion. The Maryland Cannabis Administration forecasts that fiscal 2025 will surpass $1.1 billion in total sales. Unlike mature Western markets such as Oregon and Washington, Maryland remains in a growth mode; social equity licensees continue to convert provisional approvals into brick-and-mortar operations, adding fresh competition every month.

Leading Brands and Industry Consolidation

Maryland's recreational segment showcases both homegrown cultivators and national multi-state operators. BDSA Retail Sales Tracking identified the five highest-grossing brands in Q2 2024: SunMed Growers led with $15.6 million in adult-use revenue (61% from flower), followed by Curio Wellness at $14.2 million (diversified across flower, edibles, pre-rolls, and vapes). Rythm, a Green Thumb Industries brand, captured $10.6 million (68% flower, 30% vapes). At the same time, Fade Company and District Cannabis rounded out the top five with strong performances in premium flower and pre-roll segments.

Chain retailers, including Rise, gLeaf, Zen Leaf, and Trulieve, operate multi-location networks statewide. Independent shops hold their own through hyper-local engagement. Peake ReLeaf in Rockville earned top honors in a 2025 Montgomery County consumer poll, distinguished by its expert staff, broad product selection, and a customer-friendly rewards structure. While MSOs command larger marketing war chests and sophisticated loyalty platforms, independents can carve defensible niches through community roots, concierge-level service, and a highly curated inventory.

Pricing Dynamics and Revenue Trends

Price erosion has reshaped Maryland's market. Average retail prices dropped approximately 40% from Q3 2021 to Q4 2022, with a temporary uptick following the launch of adult-use sales in July 2023. By August 2025, the average transaction stood at roughly $27, down from $29.41 in the prior August. Yet, monthly sales volumes remain healthy; in August 2025, there was nearly $99 million in product sales. Sustaining margins in this deflationary environment demands operational discipline, larger basket strategies, premium-tier differentiation, and retention programs that drive repeat visits.

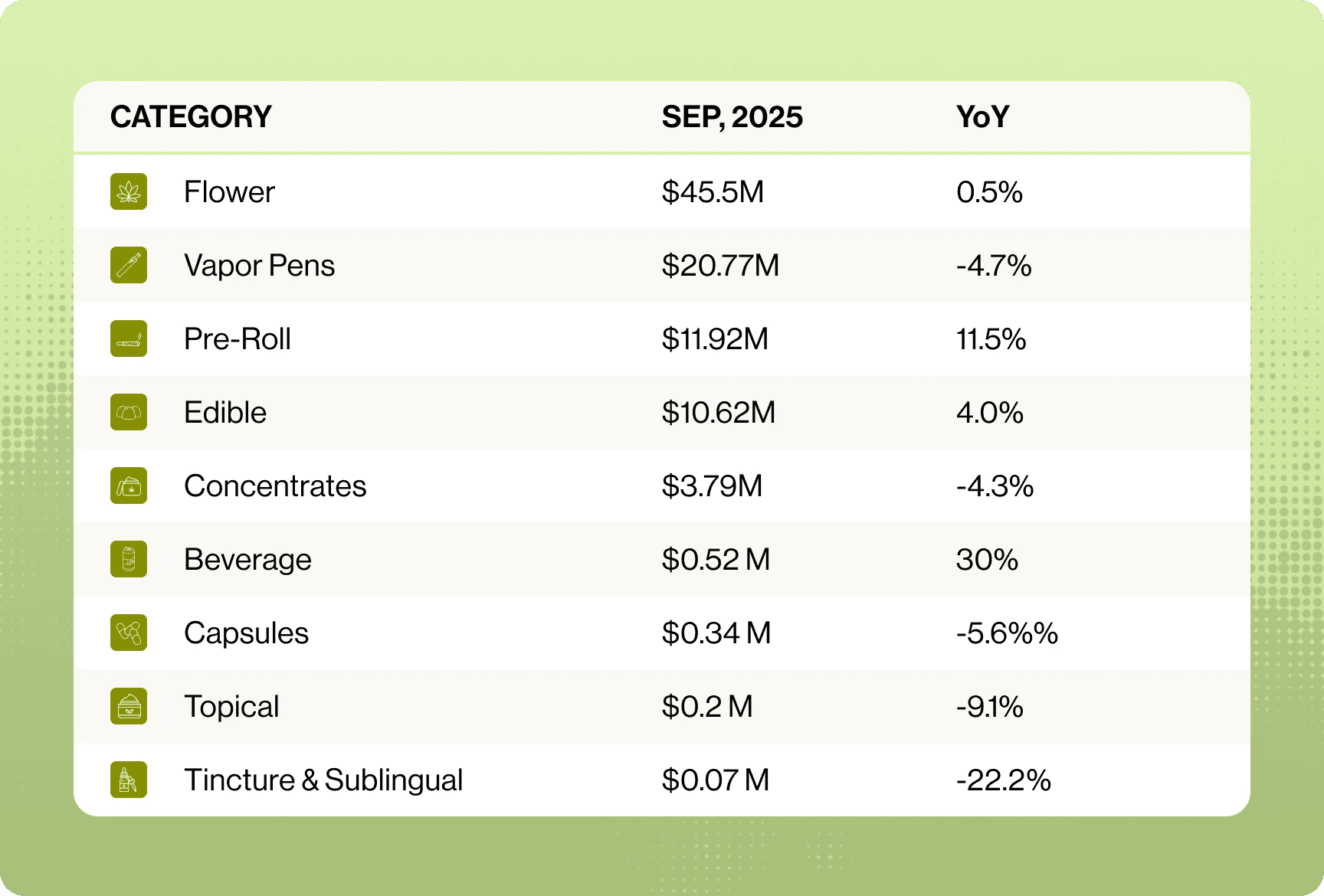

Category Mix and Buying Behavior

Maryland consumers mirror national patterns with state-specific nuances. In FY 2022's medical program, flower commanded 49% of dollar volume, vapes took 22%, and edibles secured 13%. The adult-use launch accelerated the convenience-product shift, as flower, pre-rolls, vapes, and edibles each claimed a greater share in the recreational channel than in the medical channel. Because adult-use purchasers cannot buy dabbable concentrates or RSO, extracts represented only 7% of medical sales during the early recreational period.

Data from Headset's Maryland market dashboard confirms flower's dominance with $48.2 million in monthly sales, followed by vapor pens at $22.1 million. Pre-rolls generated $12.5 million at an average $13.81 per unit and posted 20.8% year-over-year unit growth, a signal of accelerating adoption. Edibles contributed $11.1 million; concentrates added $3.95 million.

The Maryland Cannabis Administration's 2025 Biannual Use Study highlights a consumer drift toward edibles and vaping, a trajectory consistent with other newly legal states. Flower retains top-method status, yet vapes and edibles have expanded meaningfully since recreational sales began. Among underage users, smoking remains most prevalent, though vaping registered the steepest prevalence increase from 2021 to 2023.

Generational Segments and Customer Archetypes

Maryland's buyer demographics span multiple generations. Industry-wide data suggest Millennials drive roughly 49% of cannabis spend, with Gen X contributing around 39%. Millennials tend to skew toward concentrates and infused pre-rolls, while Gen X splits its wallet share between concentrates and vapes. Boomers, on the other hand, prefer vapes and pre-rolls. Applying these generational lenses to Maryland's merchandising and messaging can unlock more precise targeting and higher conversion rates.

Building Your Maryland Cannabis Marketing Plan

A winning marketing approach begins with gaining deep insights into your audience, the regulatory framework within which you operate, and the competitive forces shaping your market. Structure your strategy using this comprehensive guide.

Setting Clear Objectives & Dispensary KPIs

Your marketing success depends on tracking the right metrics and understanding how they connect to your bottom line. We developed BNCHMRK, a dataset of key dispensary KPIs, to assist owners, operators, and marketing leaders in better understanding the efficacy of their marketing efforts by looking at a confluence of store-level, order-level, and loyalty-based metrics.

The nine key KPIs connect marketing activities with the income statement and help govern channel-related activity. By leveraging our proprietary BNCHMRK dataset, you can develop an understanding of how various channel-specific KPIs collectively contribute to broader, overall order—and store-level performance.

Store-Level Metrics

Store-level metrics focus on overall business health and performance:

- Marketing Efficiency Ratio (MER): Measures total revenue generated per marketing dollar spent.

- Acquisition Marketing Efficiency Ratio (aMER): Evaluates revenue specifically attributable to new customer acquisition relative to marketing spend.

Order-Level Metrics

Order-level metrics analyze individual customer transactions:

- Cost Per Order (CPO): Tracks marketing spend efficiency per transaction.

- Customer Return Rate: This metric highlights the proportion of customers who make repeat purchases, indicating the effectiveness of marketing in driving ongoing customer engagement.

Loyalty & Retention Metrics

Loyalty-based metrics evaluate customer retention and long-term value:

- Customer Review Rate: Indicates the percentage of customers who leave reviews, reflecting engagement and overall satisfaction.

- New Customer Review Rate: Specifically measures engagement among new customers.

- Loyalty Program Opt-In Rate: Measures how effectively customers enroll in loyalty programs.

- New Customer Loyalty Opt-In: Evaluates initial engagement by new customers with loyalty programs.

- Marketing Opt-In Rate: Evaluates the effectiveness of customer consent for marketing communications, highlighting opportunities for ongoing relationship building.

Budgeting & Resource Allocation

Your marketing budget should reflect your dispensary's stage in business, its competitive landscape, and specific business objectives. Aligning your marketing spend with clear KPIs keeps marketing activities accountable and maximizes the marginal contribution of each marketing dollar spent.

Creating Your Dispensary's Marketing Budget

Creating an adequate marketing budget requires assessing three key factors:

- Business Stage: Are you launching, growing, or mature?

- Market Competitiveness: Is your dispensary in a densely competitive urban area or a more rural, less competitive market?

- Revenue Levels: Established dispensaries allocate around 1–2% of topline revenue to marketing. Newer dispensaries or those in competitive markets may need to allocate more.

Allocating Your Budget

Strategically distribute your budget to balance foundational growth with targeted expansion:

Foundational Channels

- Website & SEO (30–40%): Optimize for local searches, ensure intuitive navigation, and prioritize mobile responsiveness.

- Email & SMS Marketing (15–20%): Build an engaged subscriber list to drive repeat visits through personalized communication.

- Local Awareness (15–20%): Invest in local events, promotions, and community engagement.

Growth Channels

- Paid Advertising: Introduce targeted paid search, social media ads, and cannabis-specific platforms incrementally, scaling based on results.

- Loyalty & Retention: Enhance loyalty programs, personalize incentives, and implement referral campaigns for high-ROI customer retention.

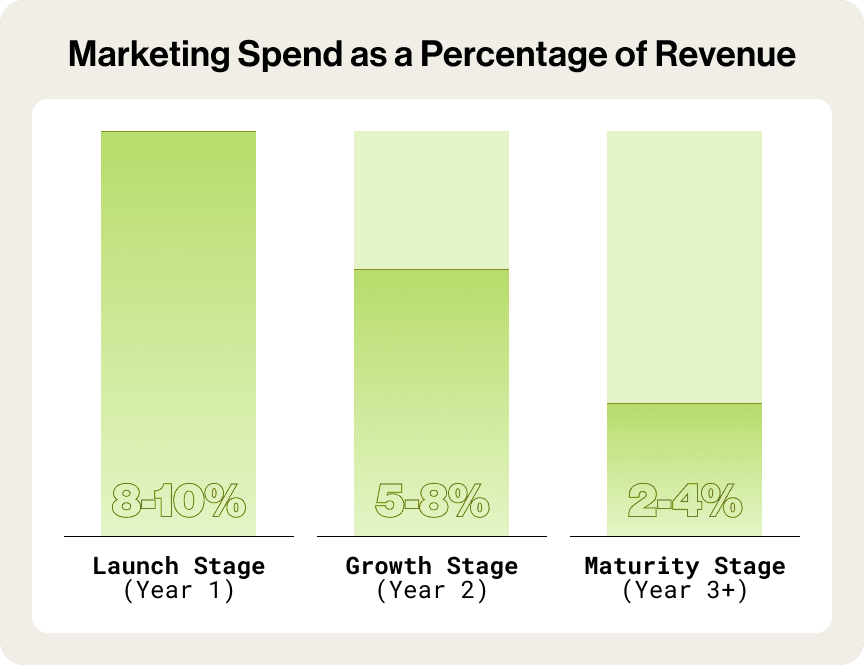

Budget Variations by Stage

Launch Stage (Year 1)

Marketing Spend: 8–10% of revenue

Focus on foundational efforts: website setup, SEO, initial customer acquisition, and establishing local brand presence.

Growth Stage (Year 2)

Marketing Spend: 5–8% of revenue

Expand paid advertising, increase SEO efforts, enhance content creation, and prioritize loyalty and retention programs.

Maturity Stage (Year 3+)

Marketing Spend: 2–4% of revenue

Refine loyalty initiatives, selectively leverage paid advertising, and focus on maximizing customer lifetime value. Aligning your marketing budget to your dispensary’s lifecycle and market realities ensures sustainable growth, optimized ROI, and lasting success.

Choosing Technology Vendors That Power Marketing Success

Your technology stack's interoperability determines both your marketing execution capabilities and adherence to compliance. Selecting the right POS system, CRM platform, and supporting tools creates the foundation for scalable, compliant, integrated marketing operations.

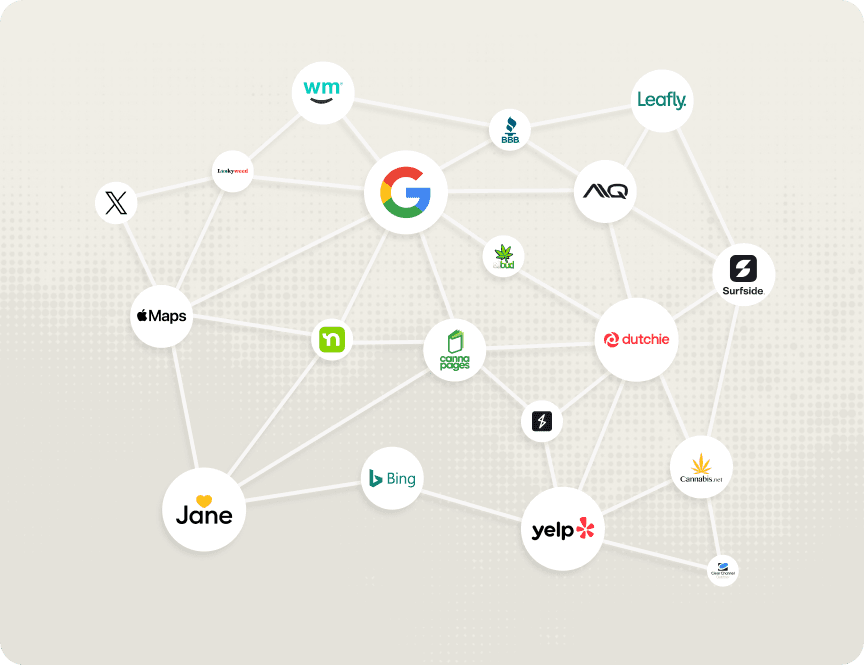

Selecting Your Online Menu & POS System

The POS system you choose should seamlessly synchronize real-time inventory across in-store terminals, online menus, and third-party marketplaces, such as Leafly and Weedmaps. Maintaining accurate product availability across these touchpoints prevents "out-of-stock" frustrations and builds consumer trust that displayed inventory reflects what's actually on your shelves.

A modern POS should deliver detailed analytics on purchase history, product performance, customer frequency patterns, and peak shopping windows, transforming raw sales data into actionable marketing intelligence. Leading Maryland operators frequently utilize platforms such as Dutchie, Leaflogix, or Flowhub. As an Agency Plus partner, we're biased toward Dutchie for its robust API ecosystem and proven reliability.

Choosing a Cannabis-Focused CRM

Beyond transaction processing, you need systems built for cannabis consumer behavior. Cannabis-focused CRMs, such as Springbig, Alpine IQ, or Happy Cabbage, enable sophisticated customer segmentation based on purchase recency, frequency, and monetary value, while supporting multi-channel communication across email, SMS, push notifications, and loyalty programs.

These platforms power automated workflows, including welcome series for new customers, win-back campaigns for lapsed buyers, personalized product recommendations, and birthday rewards, all while maintaining built-in age verification and consent management for regulatory compliance.

Integration & Compliance

Select vendors committed to seamless interoperability. Real-time synchronization between your POS, CRM, and online menu platforms ensures accuracy across all customer touchpoints and eliminates compliance vulnerabilities created by data silos.

Your integrated stack should include built-in Metrc integration for automatic seed-to-sale tracking, age verification at every digital touchpoint, automated tax calculations that clearly communicate Maryland's cannabis excise tax, and data security protocols that protect sensitive customer information. The right technology infrastructure transforms every customer interaction into actionable marketing opportunities while maintaining unwavering compliance standards.

Implementing Your Dispensary Marketing Strategy

Executing your marketing plan requires coordinating multiple channels to create a cohesive customer experience that drives discovery, builds trust, and fosters loyalty.

Website Design & Development – Your Digital Storefront

- First impressions drive trust: Most consumers form opinions within seconds; a professional, mobile-responsive design with real-time menu integration immediately establishes credibility and converts browsers into buyers.

- Mobile optimization is non-negotiable: The majority of cannabis shoppers research on their phones; fast-loading, intuitive mobile experiences directly impact conversion rates.

- Serve as a trusted guide: Integrate comprehensive product descriptions, terpene profiles, potency data, and educational content about Maryland's laws and consumption methods—positioning your website as your most valuable sales tool.

- Optimize the user journey: Simplify product discovery through intuitive filtering by category, brand, or effect, and offer online ordering with in-store pickup to eliminate friction.

Local SEO – How Customers Find You

- Visibility at the right moment: Consumers searching for "dispensary near me" typically purchase within hours; strong local rankings directly translate into increased foot traffic and revenue.

- Optimize your Google profile: Maintain an information-rich Google Business Profile with accurate details and regular updates to outperform competitors and earn consumer trust.

- Reviews matter: Fresh, positive reviews boost local rankings and influence purchasing decisions. Encourage satisfied customers to share feedback and respond professionally to all reviews.

- Local content connects: Publish articles on Maryland cannabis culture, community events, legislative updates, and product education to capture local search traffic and drive engagement.

Email & SMS Marketing – Bringing Back Regulars

- Build your list strategically: Offer compelling incentives, such as exclusive discounts, early access, orloyalty points, to convert visitors into subscribers and drive repeat business.

- Segmentation drives results: Group customers by purchase habits and preferences to deliver personalized offers that dramatically outperform generic messaging.

- Automate to scale engagement: Deploy automated welcome sequences, birthday rewards, and reactivation campaigns to maintain consistent communication without overwhelming your team.

- Compliance handled seamlessly: Implement age verification meeting MCA requirements while maintaining a smooth user experience.

Paid Advertising – Amplifying Your Reach

- Multi-channel impact: Combine search marketing, programmatic display, and cannabis-friendly networks to reach customers at multiple touchpoints, delivering higher engagement than isolated tactics.

- Target strategically: Focus campaigns within your delivery radius on strictly adult demographics, avoiding messaging that could appeal to minors or suggest cross-border transport.

- Community partnerships amplify reach: Sponsor local festivals, charitable initiatives, and business associations to enhance visibility and demonstrate a commitment to the community.

- Track to optimize: Use dedicated tracking methods—unique phone numbers, promo codes, landing pages—to measure performance and adjust spending based on conversion data and ROI.

Maryland Dispensary Marketing FAQs

Can dispensaries advertise in Maryland?

Yes. Maryland permits cannabis advertising across digital, print, broadcast, and out-of-home channels, but imposes strict content and audience restrictions:

Content restrictions:

- Ads may not include medical or therapeutic claims unless backed by clinical trials

- Cannot be false or misleading

- May not depict minors or encourage excessive consumption

Placement & audience requirements:

- Billboards and signage must be on-premises only

- Cannot be placed on public buildings or within school zones

- May not target individuals under 21

- TV, radio, digital, and live event ads must demonstrate that at least 85% of the audience is 21+

- Websites must use neutral age gating

Are dispensaries in Maryland profitable?

Profitability varies widely. The market shows strong demand but faces margin pressure:

Market strength:

- Adult-use sales surged to $806 million in 2024

- Monthly sales reached roughly $98.98 million in August 2025

Challenges:

- Price compression: average item price fell from $29.41 to $27.00 over the past year

- The average cost per gram was about $9.21 in early 2024

- High taxes, rising to 12%

- Competition from large chains squeezes margins

Success factors: Dispensaries that manage costs effectively, differentiate themselves through service and product selection, and build loyal customer bases can capitalize on opportunities in Maryland's robust and rapidly growing market.

How much does a dispensary owner in Maryland make?

Earnings depend on multiple factors, including store size, location, overhead, and operational efficiency:

Location dynamics:

- Urban areas (Baltimore, D.C. suburbs): Higher foot traffic but steeper competition

- Rural/border locations: May capture cross-state demand but must adhere to advertising rules prohibiting encouragement of out-of-state purchases

Growth trajectory:

- New stores often operate at thin margins initially.

- Successful owners typically reinvest profits into additional locations, technology upgrades, and marketing to maintain growth.

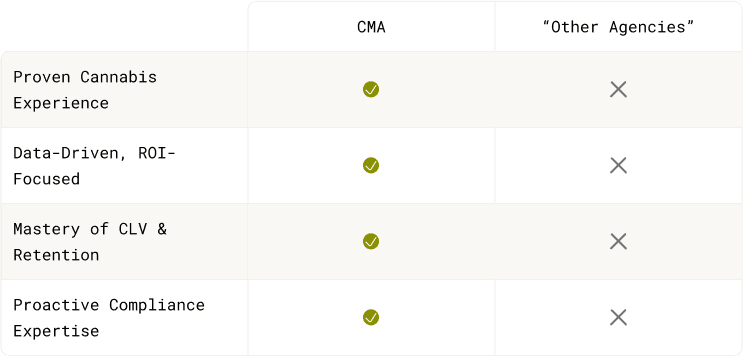

Working with Cannabis Marketing Experts

Building effective dispensary marketing in Maryland requires specialized knowledge that general marketing agencies typically lack. The state's unique regulatory environment, competitive dynamics, and consumer behavior patterns present challenges that cannabis-focused professionals can effectively address.

If you decide to work with a Maryland Cannabis Marketing Agency, here are a few things to remember:

- Prioritize proven cannabis experience. When evaluating potential partners, it's essential to understand what a cannabis marketing company does and whether it's worth the investment, ensuring you choose an agency aligned with your dispensary's unique goals. Look for agencies with case studies in Maryland or comparable markets.

- Demand data-driven approaches. Your agency should focus on measurable results rather than vanity metrics, providing specific ROI examples and performance benchmarks from comparable dispensary clients. They should understand the cannabis industry's customer lifetime value, acquisition costs, and retention strategies.

- Ensure cultural alignment. Cultural alignment becomes crucial because cannabis marketing necessitates a genuine understanding of the community and customer mindset. Select a partner who can communicate effectively with local consumers and navigate the complexities of Maryland's regulations.

- Verify compliance processes. The agency should build comprehensive compliance processes into every campaign and strategy. Your marketing agency should have a deeper understanding of Maryland cannabis regulations than you do, with systems and procedures that prevent violations before they occur, rather than addressing problems after they happen.

Seizing Maryland's Cannabis Market Moment

Maryland's recreational cannabis landscape is wide open—but the window for early-mover advantage is closing fast. As the market matures beyond its medical roots, dispensaries face a defining choice: build a marketing engine that compounds over time, or risk having national operators and better-capitalized competitors claim their customers.

Master the basics before scaling ambition.

Winning doesn't require perfection; it requires consistency. A high-performing website, verified Google Business Profile, permission-based text and email lists, and genuine local partnerships will outperform flashy campaigns every time. The dispensaries that dominate in 2026 are the ones building these assets today, testing methodically, and doubling down on what converts.

Know which battle you're fighting.

Every Maryland dispensary faces one of three strategic challenges right now:

Invisibility. Hundreds of competitors are vying for attention. If customers don't know you exist, everything else is irrelevant.

Hesitation. Traffic is coming to your site, but visitors aren't converting to customers. Something in your digital experience is breaking trust.

Churn. First-time buyers aren't coming back. You're spending to acquire customers you'll never see again.

Identify your constraint, then build everything around solving it. Track the metrics that matter—such as store visits, basket size, and30-day return rate—and ignore vanity numbers.

Build infrastructure that survives disruption.

Expect Maryland's regulatory environment, pricing dynamics, and competitive landscape to undergo significant changes over the next 24 months. The dispensaries that survive aren't the ones with the largest budgets; they're the ones with integrated systems that surface insights faster than the market changes. Connect your point-of-sale system, customer database, and analytics tools so you can identify patterns before your competitors do. Make decisions from your data, not your assumptions.

Stop planning. Start moving.

Maryland's opportunity rewards action, not analysis. The dispensaries capturing market share right now aren't the ones with perfect strategies—they're the ones launching campaigns, measuring results, and iterating on a weekly basis. Compliance and community trust aren't constraints; they're competitive moats that keep out operators who cut corners.

The market is shifting, your move.

About The Cannabis Marketing Agency

The Cannabis Marketing Agency: Cannabis marketing experts making your dispensary the one everyone talks about (in a good way).

We make your dispensary the local favorite — the spot people talk about, shop at, and keep coming back to.

+4 Years Growing Dispensaries: We don't "learn on your dime".

Trusted by Dispensaries in 18 Markets: From Cali to Mass, if it’s legal, we’ll help you win.

For DIYers who hate learning the hard way.

Want More Dispensary Customers?

We grow dispensaries like it’s our day job (because it is). Ever wonder what we’d do for yours? Let’s find out.

Get Started