Marketing a Minnesota Dispensary in Year 1. No Ads Required.

Marketing a Minnesota Dispensary in Year 1. No Ads Required.

Insights | 2025-08-04

Eric Allred - Head of Product

Consider this scenario. You've secured one of Minnesota's coveted preliminary licenses in the social equity lottery.

Still, as you prepare to open your doors in late 2025, you're watching tribal dispensaries like Red Lake's NativeCare build customer loyalty while finalizing your build-out. Meanwhile, established medical operators Green Goods and RISE are converting their patient base to adult-use customers, creating a head start that feels unfair.

This is not a timing problem; it's a positioning problem, a common challenge that most Minnesota dispensary operators will face as the market launches. Minnesota's cannabis market represents a rare opportunity in the industry: a fresh start in a state with proven consumer demand, limited competition, and regulations designed to prevent the oversaturation that plagued other markets.

But here's what we've learned from working with dozens of dispensaries nationwide: the ones that thrive aren't necessarily the first to market or the best-funded. They're the ones that understand their customers, execute consistently on fundamentals, and build sustainable competitive advantages before the market matures.

This guide will educate you on navigating Minnesota's marketing regulations, building a cannabis marketing foundation that scales, implementing effective customer acquisition strategies, and creating measurable systems for long-term growth in an emerging market.

Let's get started.

Key Takeaways

- Clearly understand Minnesota's cannabis market dynamics to position your dispensary effectively in this emerging, regulated environment.

- Build on existing consumer behavior from the hemp beverage boom to predict purchasing patterns and merchandise your dispensary with products that align with established preferences.

- Leverage first-mover advantages through early community engagement and customer data collection before the market becomes saturated with competitors.

- To protect your dispensary from compliance risks, adhere to Minnesota's strict advertising guidelines and focus on education-based marketing approaches.

- Partner with established Minnesota-focused cannabis brands and local suppliers to capture existing consumer loyalty and cultural alignment.

- Establish compliance-first operations with proper Metrc integration and packaging requirements to avoid costly violations that could impact your license.

- Clearly define KPIs and implement data-driven measurement systems to optimize your marketing spend and track customer acquisition effectively.

- Focus on developing customer retention strategies through loyalty programs, personalized marketing, and exceptional service, as license caps limit competition but reward operational excellence.

Understanding the Minnesota Cannabis Marketing Landscape

Working Within Minnesota's Regulatory Framework

When Minnesota legalized adult-use cannabis in 2023, legislators crafted a framework explicitly designed to avoid the pitfalls of other states. The social equity lottery system, population-based license caps, and tribal sovereignty protections create a unique ecosystem that rewards preparation and community engagement over pure capital deployment.

These regulatory constraints aren't obstacles but present a strategic advantage for operators who understand how to work within them. License caps prevent the oversaturation that destroyed margins in California, Oregon, and Washington, while the phased rollout gives early entrants time to build customer relationships before competition intensifies.

Minnesota's advertising restrictions create differentiation opportunities.

Minnesota's cannabis advertising laws prohibit false health claims, imagery appealing to minors, and outdoor advertising except for two fixed signs on your property. Digital advertising requires age verification, and pop-up ads are completely forbidden.

These restrictions fundamentally reshape your marketing approach, similar to Illinois but with additional digital constraints. The most successful Minnesota dispensaries will adapt by focusing on education-driven content, community partnerships, and exceptional in-store experiences.

No flashy billboards or aggressive social media campaigns; success comes the old-fashioned way, building authentic relationships, shared values, and word-of-mouth.

The Metrc tracking system affects your marketing operations.

Minnesota contracted Metrc as its official seed-to-sale tracking system. Every product must be tracked from cultivation to final sale.

Your inventory must align with your promotions, and your POS system requires seamless interoperability to prevent compliance violations.

Effectively integrating Metrc enables owners to transparently educate customers about product origins, test results, and cannabinoid profiles, building trust through data rather than empty marketing claims.

The tax structure influences every customer interaction.

Minnesota levies a 15% gross receipts tax (increased from 10% in 2025) plus the 6.875% state sales tax.

Local governments can add registration fees and limit dispensary density to one per 12,500 residents. This tax burden creates pricing challenges and opportunities for dispensaries that position themselves as premium experiences worth the additional cost.

High taxes attract discerning customers who research purchases and value expert guidance over low prices. Similar to the Illinois market, it becomes an exercise in developing the capability to communicate the value of the transaction.

Competitive Landscape in Minnesota

Minnesota's cannabis market appears a tad overwhelming at first glance. Established medical operators like Green Goods and RISE have large, active, existing customer bases. Then there are the tribal nations that operate the only adult-use stores.

There's more? Yes, hundreds of new licenses will create competition and flood the market with products.

However, this perspective misses the fundamental opportunity: Minnesota is starting fresh with proven consumer demand and structural protections against oversaturation.

The bigger thing to watch is whether and for how long local regulators will keep their promise on license caps. Our client EMBR Dispensary's La Mesa location was said to be capped at six licenses; currently, 13 dispensaries are operating in the area.

It's good lip service, but only time will tell.

Limited competition creates first-mover advantages.

With only 249 preliminary licenses awarded across all license types and regulations predicting roughly 150 retailers by late 2025, Minnesota won't experience the competitive chaos that destroyed margins in other states (we're looking at the 600+ dispensaries you got, Michigan!).

Early entrants can build brand loyalty, robust customer files, and optimize operations before the market matures.

The medical market consists of just two manufacturers operating 14 dispensaries statewide, while tribal operations like NativeCare, Waabigwan Mashkiki, and Island Peži serve limited geographic areas.

This creates enormous white space for new entrants who execute effectively.

Cross-border dynamics create additional opportunity.

Minnesota borders states where cannabis remains illegal, creating pent-up demand similar to Michigan's Indiana, Illinois, and Ohio borders. While adult-use dispensaries aren't operational yet, the current hemp beverage success demonstrates that consumers will travel and pay premium prices for legal access.

While dispensaries near Wisconsin, Iowa, or North Dakota borders will have a short-term opportunity to capture tourism traffic, long-term success depends on serving Minnesota residents rather than on out-of-state volume.

Consumer Trends and Preferences in Minnesota

To understand the Minnesota consumer, we must go beyond the limited medical data and analyze the hemp beverage explosion and adjacent market behavior.

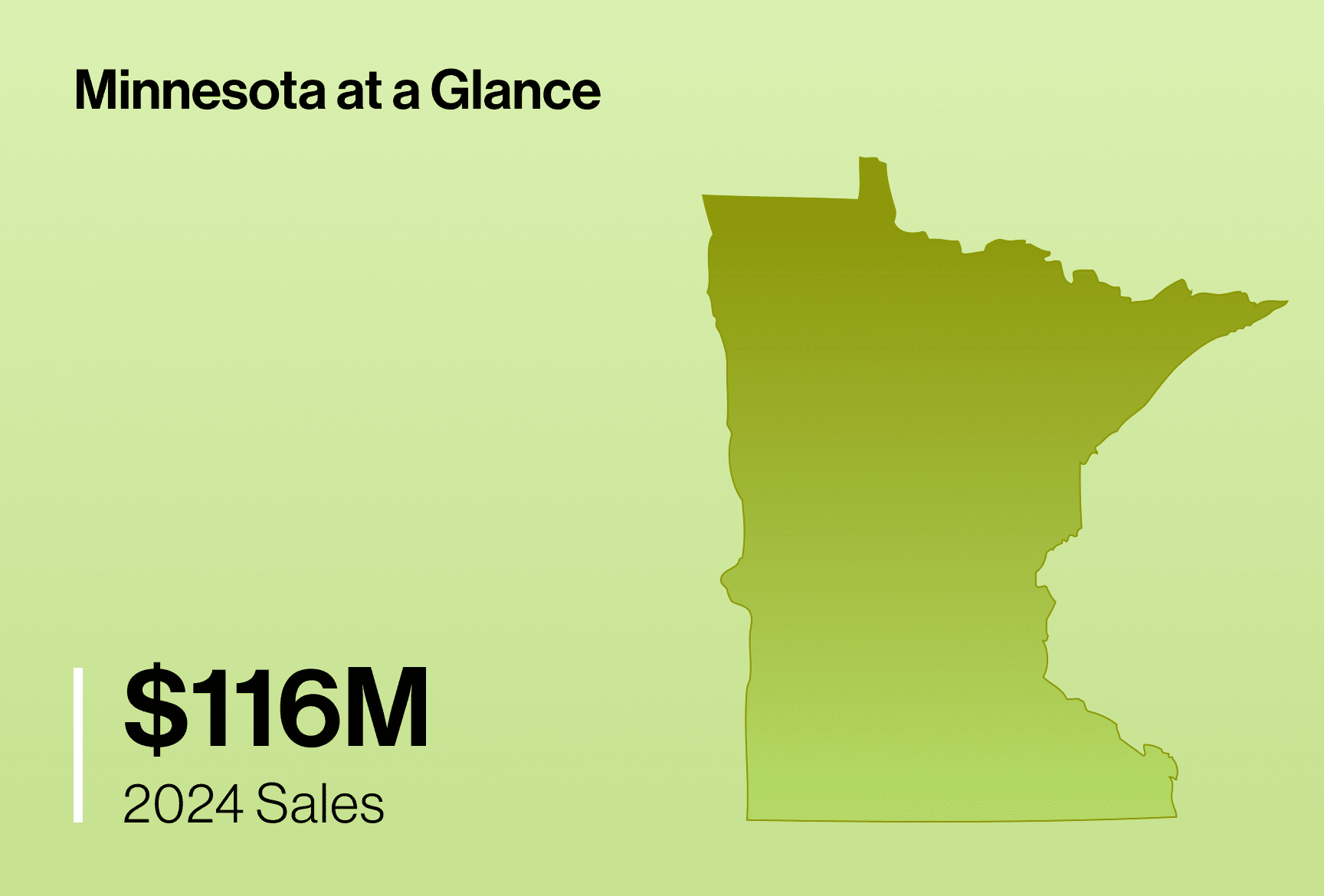

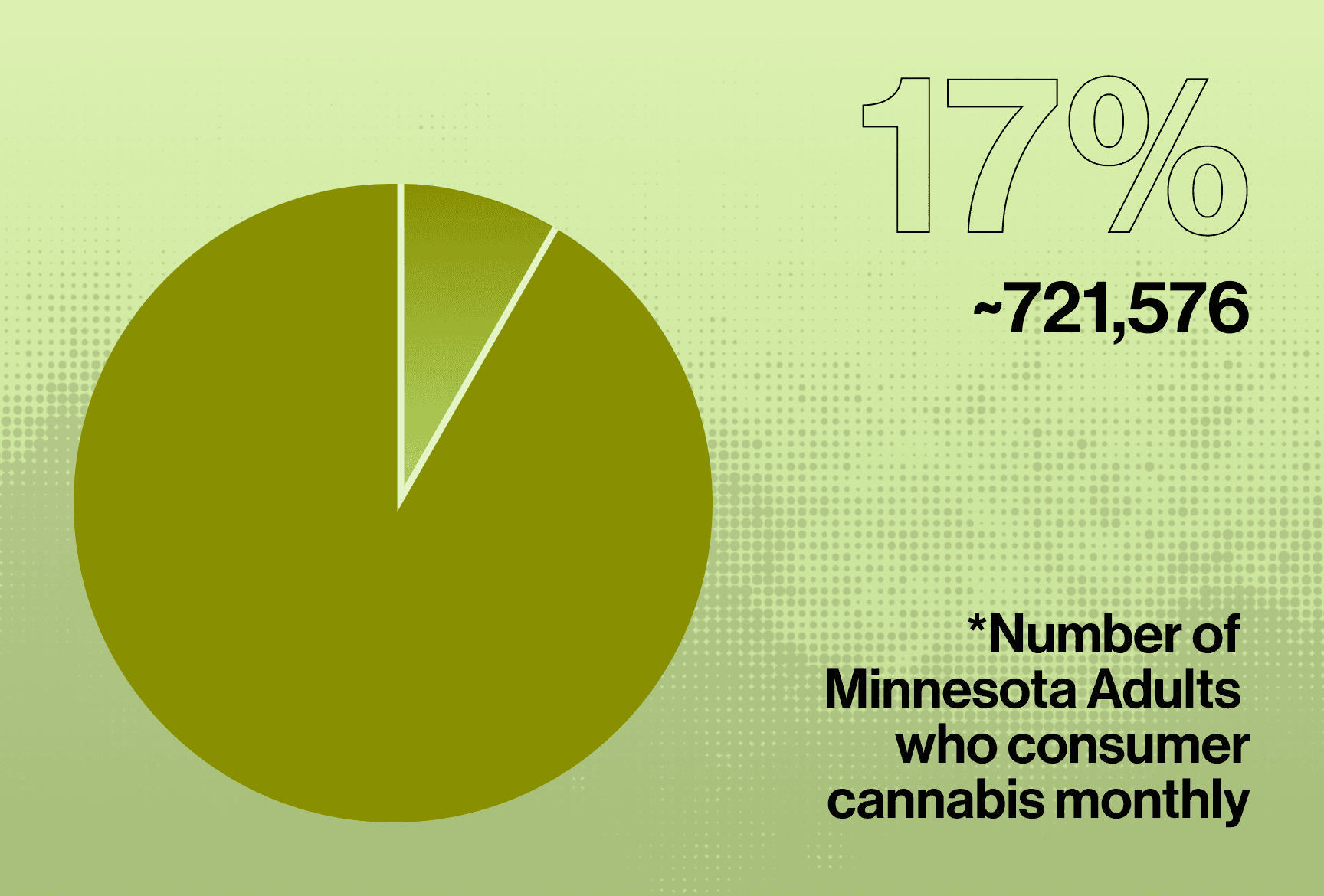

Analysts estimate 17% of Minnesota adults (approximately 721,576 people) consume cannabis monthly, representing a substantial market opportunity with established purchasing patterns and price elasticity in the market.

Category trends and the hemp beverage boom reveal shifting preferences.

Minnesota's explosive hemp-derived THC beverage market provides some light early into consumer behavior. Local taprooms report 25% of sales coming from THC beverages during peak periods, major retailers like Cub Foods and Total Wine stock THC products, and approximately 4,000 businesses were registered to sell hemp-derived products by July 2024.

This data reveals a consumer base that is incredibly comfortable with cannabis, interested in low-dose products, and willing to pay premium prices for convenience and quality; this customer archetype drives a dispensary's profitability.

On the medical side, patients still prioritize traditional flower and concentrates; the adult-use market will likely skew toward accessible products like pre-rolls, gummies, and beverages that appeal to cannabis-curious consumers.

Brand loyalty exists but requires cultivation.

Minnesota's small dispensary network prioritizes customer experience. Green Goods and RISE maintain 4.5-4.8 star ratings through knowledgeable staff, patient education, and comprehensive loyalty programs. Both companies offer point-based rewards and compassion discounts that drive repeat visits.

In the hemp market, brands like Waabigwan Mashkiki, NativeCare, and Superior Cannabis Company build loyalty through cultural alignment, local sourcing, and community involvement; demonstrating the power of authentic Minnesota connections over generic cannabis branding.

Minnesota culture influences purchase decisions.

Minnesota consumers value authenticity, community involvement, and environmental responsibility. They support businesses that reflect local values, craft brewing culture, outdoor recreation, and social equity commitments.

Weaving these cultural elements into your brand story and operational practices can give you a competitive advantage as a new dispensary operator.

Building Your Minnesota Cannabis Marketing Plan

- Most dispensary marketing plans fail because they prioritize tactics over strategy. When operators jump headfirst into social media, loyalty programs, and paid advertising without establishing clear objectives and measurement frameworks, they waste limited resources and create the illusion of progress without meaningful results.

Minnesota's emerging market requires a foundation-first approach. The goal is to build sustainable, relative advantages in the early innings. It's better to have something and not need it than to need something and not have it.

Setting Clear Objectives & Dispensary KPIs

Your data tells a story. We developed BNCHMRK, a dataset of key dispensary KPIs, to assist owners, operators, and marketing leaders in better understanding the efficacy of their marketing efforts by looking at a confluence of store-level, order-level, and loyalty-based metrics.

The nine key KPIs connect marketing activities with the income statement and help govern channel-related activity. By leveraging our proprietary BNCHMRK dataset, you can develop an understanding of how various channel-specific KPIs collectively contribute to broader, overall order—and store-level performance.

Store-Level Metrics

Store-level metrics focus on overall business health and performance:

- Marketing Efficiency Ratio (MER): Measures total revenue generated per marketing dollar spent.

- Acquisition Marketing Efficiency Ratio (aMER): Evaluates revenue specifically attributable to new customer acquisition relative to marketing spend.

Order-Level Metrics

Order-level metrics analyze individual customer transactions:

- Cost Per Order (CPO): Tracks marketing spend efficiency per transaction.

- Customer Return Rate: Highlights the proportion of customers making repeat purchases, indicating marketing's effectiveness in driving ongoing customer engagement.

Loyalty & Retention Metrics

Loyalty-based metrics evaluate customer retention and long-term value:

- Customer Review Rate: Indicates the percentage of customers leaving reviews, reflecting engagement and satisfaction.

- New Customer Review Rate: Specifically measures engagement among new customers.

- Loyalty Program Opt-In Rate: Measures how effectively customers enroll in loyalty programs.

- New Customer Loyalty Opt-In: Evaluates initial engagement by new customers with loyalty programs.

- Marketing Opt-In Rate: Assesses the success of customer consent to marketing communications, highlighting potential for ongoing relationship building.

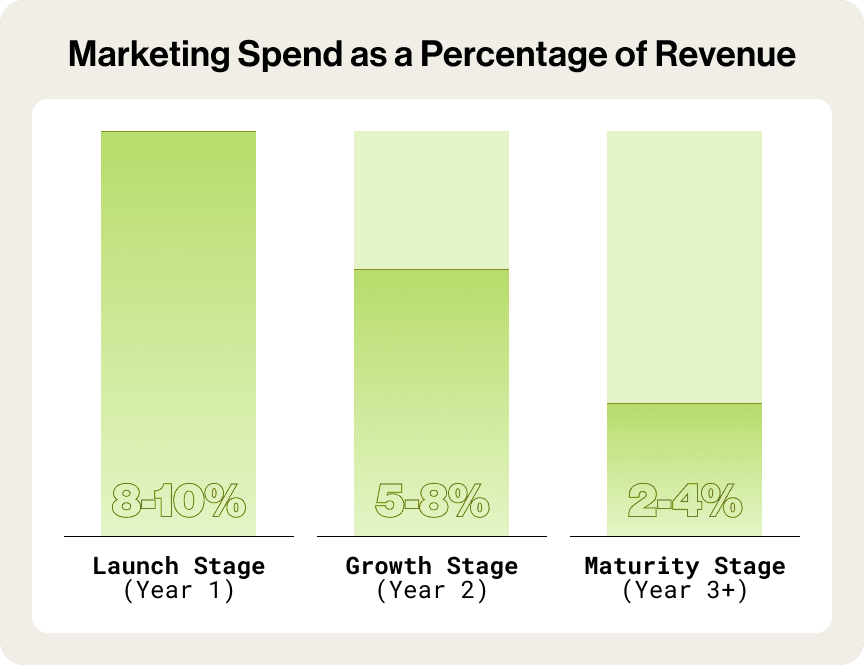

Budgeting & Resource Allocation

Your marketing budget should reflect your dispensary's business stage, competitive landscape, and specific business objectives. Aligning your marketing spend with clear KPIs ensures efficient resource use and maximum ROI.

Creating Your Dispensary's Marketing Budget

Creating an adequate marketing budget requires assessing three key factors:

- Business Stage: Are you launching, growing, or mature?

- Market Competitiveness: Is your dispensary in a densely competitive urban area or a more rural, less competitive market?

- Revenue Levels: Established dispensaries allocate around 1–2% of topline revenue to marketing. Newer dispensaries or those in competitive markets may need to allocate more.

Allocating Your Budget

Strategically distribute your budget to balance foundational growth with targeted expansion:

Foundational Channels

- Website & SEO (30–40%): Optimize for local searches, ensure intuitive navigation, and prioritize mobile responsiveness.

- Email & SMS Marketing (15–20%): Build an engaged subscriber list to drive repeat visits through personalized communication.

- Local Awareness (15–20%): Invest in local events, promotions, and community engagement.

Growth Channels

- Paid Advertising: Introduce targeted paid search, social media ads, and cannabis-specific platforms incrementally, scaling based on results.

- Loyalty & Retention: Expand loyalty programs, personalized incentives, and referral campaigns for high-ROI customer retention.

Budget Variations by Stage

Launch Stage (Year 1)

Marketing Spend: 8–10% of revenue

Focus on foundational efforts: website setup, SEO, initial customer acquisition, and establishing local brand presence.

Growth Stage (Year 2)

Marketing Spend: 5–8% of revenue

Expand paid advertising, increase SEO efforts, enhance content creation, and prioritize loyalty and retention programs.

Maturity Stage (Year 3+)

Marketing Spend: 2–4% of revenue

Refine loyalty initiatives, selectively leverage paid advertising, and focus on maximizing customer lifetime value.

Aligning your marketing budget to your dispensary’s lifecycle and market realities ensures sustainable growth, optimized ROI, and lasting success.

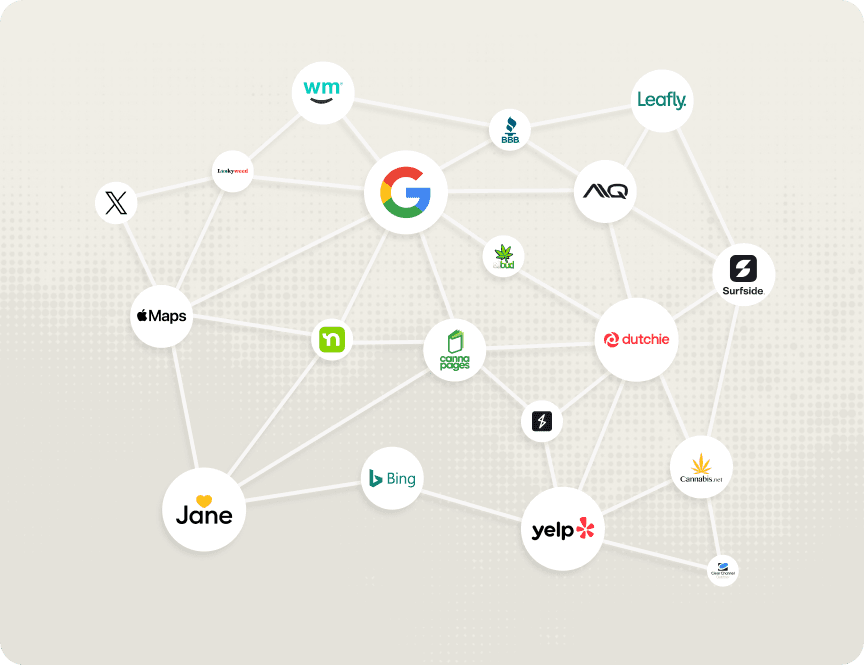

Choosing Technology Vendors That Power Marketing Success

The technology underpinning your Minnesota dispensary acts as a compliance and marketing lifeline. Deciding on the right online menu & POS system ensures Metrc compliance, builds customer trust, and maximizes the effectiveness of permitted marketing strategies. When choosing vendors for Minnesota operations, prioritize these three integrated components:

Selecting Your Online Menu & POS System

A POS should synchronize real-time inventory across your in-store terminals, website via the online menu, and Minnesota's mandatory Metrc system. Accurately tracking products from seed to sale prevents costly compliance violations while simultaneously establishing customer confidence.

Your POS and online menu vendor should also offer detailed analytics on purchase history, compliance metrics, and customer behavior patterns. This data will help inform your decision-making process week in and week out; it should also handle age verification and easily integrate with your loyalty provider. As an Agency Plus partner, we are biased, and for good reason, towards Dutchie.

Choosing a Cannabis-Focused CRM

Beyond transactions, you need to implement a cannabis-focused CRM (e.g., Alpine IQ, Springbig, etc.). You can segment customers by purchase patterns (Recency, Frequency, Monetary Value) and preferences while maintaining proper consent tracking and communication compliance.

You should be able to send targeted messages across email, push, and text channels. Integrating loyalty programs and automated rewards ensures you build lasting customer relationships through permitted channels when traditional advertising is restricted.

Integration & Compliance

Choose vendors experienced with Minnesota's specific regulatory requirements. Real-time sync between POS, menu, CRM, and Metrc platforms ensures consistency across all touchpoints, while built-in compliance features automatically handle age verification, tax calculations, and regulatory reporting. This reduces administrative burdens and keeps your marketing within Minnesota's strict guidelines while maximizing the impact of direct customer engagement strategies.

Implementing Your Dispensary Marketing Strategy

Effective dispensary marketing in Minnesota integrates multiple channels within strict regulatory constraints. Each channel plays a distinct role and acts as a touchpoint in building customer relationships, primarily when traditional advertising is heavily restricted.

Sustained success requires optimizing these channels individually and collectively to create trust-based, compliant customer experiences.

Website Design & Development – Your Digital Foundation

- First impressions establish credibility: Your website is the primary brand touchpoint where compliance and professionalism drive customer confidence.

- Age verification builds trust: Protect your business and establish yourself as a responsible operator with proper age gating and disclaimers.

- Educational content converts visitors: Most shoppers visit your website before your store, so integrate real‑time menus and educational content that positions you as a trusted guide.

- Local optimization captures intent: Publish Minnesota-specific content, highlight community involvement, and leverage location and service pages to help customers find you organically through search engines like Google.

Local SEO – Your Primary Discovery Channel

- Organic visibility becomes essential: Most customer discovery happens through local search, making top rankings crucial for store traffic.

- Complete profiles drive trust: Fully optimized Google Business Profiles with regular updates, photos, and community engagement establish credibility in Minnesota's emerging market.

- Local signals dominate: Citations, reviews, and Minnesota-focused content capture "dispensary near me" searches while building authority within state-specific directories and cannabis platforms.

Email & SMS Marketing – Direct Relationship Building

- Convert one‑timers into regulars: Most first‑time customers never return, but subscribers receiving emails and texts are far more likely to purchase. Automated campaigns generate notably more revenue than non‑automated messages.

- Mobile‑first communication: SMS messages have exceptionally high open and read rates, and over two‑thirds of digital messages are read on mobile devices.

- Segmentation and personalization: Group customers by behaviour and preferences to send relevant product suggestions and educational content. A multi‑channel welcome series can significantly increase lifetime value.

- Compliance built in: Use platforms that handle age verification, opt‑ins, and regulatory rules so you can focus on nurturing customer relationships.

Community Engagement – Building Local Presence

- Visibility through involvement: When traditional advertising is restricted, community participation becomes your primary brand awareness strategy, connecting with Minnesota audiences through shared values and local events.

- Partnership-driven growth: Collaborations with complementary businesses, medical providers, and community organizations create referral networks while building credibility in Minnesota's cannabis community.

Minnesota Dispensary Marketing FAQs

Can dispensaries advertise in Minnesota?

Yes, but within carefully defined parameters that require strategic navigation. Minnesota allows cannabis advertising in adult-oriented publications, digital platforms with age verification, and radio/TV where less than 30% of the audience is under 21. Every campaign must avoid false health claims, imagery appealing to minors, and pop-up internet ads while maintaining compliance with packaging and warning requirements.

Are dispensaries in Minnesota profitable?

Minnesota dispensaries have strong profitability potential due to limited competition (roughly 150 retailers are expected by late 2025), well-established, proven consumer demand from the hemp beverage market, and license caps intended to prevent oversaturation.

However, success depends heavily on managing the 15% gross receipts tax plus sales tax, compliance costs, and acquiring and retaining customers without giving away excess margin through general promotions.

The state's regulatory structure protects existing operators while growing consumer acceptance expands market opportunity.

How much does a dispensary owner in Minnesota make?

While adult-use sales haven't begun, industry projections suggest successful Minnesota dispensary owners could earn between $150,000 and $400,000 annually, with top performers potentially reaching higher levels. These estimates reflect the projected $1.4-1.5 billion market size, limited competition, and premium pricing environment. Individual results will vary significantly based on location quality, operational efficiency, marketing effectiveness, and customer retention strategies.

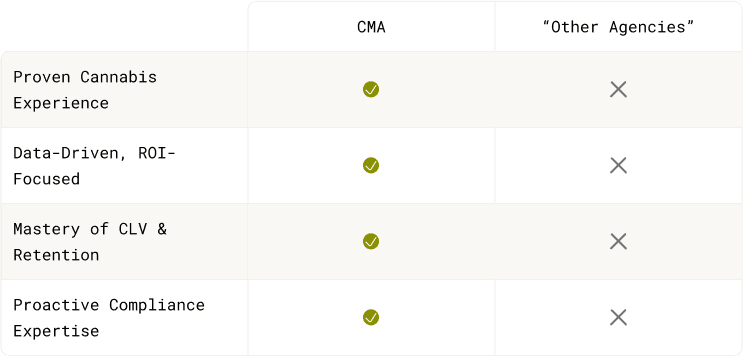

Working with Cannabis Marketing Professionals

Building effective dispensary marketing in Minnesota requires specialized knowledge that most general marketing agencies lack.

The state's unique regulatory environment, cultural dynamics, and emerging market conditions create challenges that generic approaches cannot address effectively.

If you decide to work with a Minnesota Cannabis Marketing Agency, here are a few things to remember.

- Prioritize Minnesota-specific experience. When evaluating potential partners, seek agencies with demonstrable expertise in emerging cannabis markets and understand Minnesota's specific regulations. For example, our work with Green Canopy, a hemp-based dispensary awarded a recreational license brought us a deep level of intimacy and familiarity with the Minnesota market.

- Demand compliance-first approaches. Your marketing agency should understand Minnesota cannabis regulations better than you do, with systems and procedures built to prevent violations before they occur. They should provide regular regulatory updates and adapt campaigns immediately when rules change.

- Ensure cultural alignment. Minnesota consumers value authenticity, community involvement, and local connections. Your marketing partner should understand how to weave elements like craft brewing culture, outdoor recreation, and social equity commitments into your brand story without appearing opportunistic.

- Verify measurement capabilities. Look for agencies focusing on measurable results rather than vanity metrics, providing specific ROI examples and performance benchmarks from comparable emerging market clients. We do this monthly, with BNCHMRK, our Dispensary KPI Report.

Moving Forward with Marketing Your Minnesota Dispensary

Minnesota offers an incredible risk-adjusted opportunity for dispensaries that can maintain a methodical approach in a nascent market. The state's regulatory structure creates barriers to protect early entrants, while proven consumer demand for hemp products demonstrates a palpable market readiness.

Success requires a systematic marketing approach that builds authentic community relationships, effectively captures customer data, and prioritizes long-term profitability over short-term volume.

Start with compliance and community.

Develop a clear regulatory understanding, properly integrate your technology, and forge authentic bonds in the community to form your foundation for sustainable growth. From there, your success will boil down to your ability to consistently execute on customer service, financial, marketing, and merchandising fundamentals, not perfect planning.

Focus on building one channel effectively before expanding your marketing initiatives. The temptation to pursue every opportunity simultaneously will spread resources too thin and reduce overall effectiveness.

Identify your big opportunity.

Your most significant marketing opportunity lies in one of three categories: how do we build awareness in an emerging market? How do we convert hemp beverage users to dispensary customers? How do we imbue loyalty before the competition heats up? Identifying your primary opportunity helps develop clear goals, prioritize resources, and create a reconciliation framework for tracking your progress against the intended outcome.

Build scalable, data-driven systems.

Dispensaries that build flexible, data-driven marketing systems will successfully adapt to changing regulations, emerging competition, and evolving consumer preferences. Invest in technology and processes that capture customer insights and facilitate personalized experiences.

The Minnesota market offers enormous opportunity, but only to dispensaries that move beyond planning and take decisive, strategic action.

The deck is dealt, it's time to play your hand.

About The Cannabis Marketing Agency

The Cannabis Marketing Agency: Cannabis marketing experts making your dispensary the one everyone talks about (in a good way).

We make your dispensary the local favorite — the spot people talk about, shop at, and keep coming back to.

+4 Years Growing Dispensaries: We don't "learn on your dime".

Trusted by Dispensaries in 18 Markets: From Cali to Mass, if it’s legal, we’ll help you win.

For DIYers who hate learning the hard way.

Want More Dispensary Customers?

We grow dispensaries like it’s our day job (because it is). Ever wonder what we’d do for yours? Let’s find out.

Get Started