Marketing Your Dispensary in Missouri’s $1B+ Cannabis Boom

Marketing Your Dispensary in Missouri’s $1B+ Cannabis Boom

Insights | 2025-08-11

Eric Allred - Head of Product

Imagine this: You've finally unlocked the doors to your Missouri dispensary after winning one of the state's highly coveted licenses. You've stocked the store with fresh products, trained your team, and built a menu assortment that can compete with anyone in the Midwest.

But six months in, you're watching a steady stream of cars, many with out-of-state plates, bypass your location to fight for the few remaining parking spots outside a competitor parking lot just a few blocks away. Your premium flower sits on immaculate shelves while the shop down the street moves product faster than you can refresh your online menu.

This bifurcation of realities isn't a product or pricing issue. Many Missouri operators face an awareness and positioning challenge in a market growing faster than almost anywhere else in the country.

Missouri's cannabis industry is a paradox: it blends lightning-fast sales growth with manageable competition, some of the lowest taxes in the nation, high consumer expectations, and unique cross-border demand that can make or break a location's profitability.

From our work with dispensaries across the Show-Me State, one thing is clear: the winners aren't always the ones with the deepest pockets or the best real estate, although that helps.

They understand Missouri's customer mix, leverage its competitive advantages, and execute a marketing system that captures loyal locals and high-value visitors from neighboring states.

This guide will walk you through Missouri's regulatory landscape, reveal the market dynamics driving success, and outline a data-driven framework for turning the state's booming cannabis demand into long-term, sustainable growth for your dispensary.

Key Takeaways

- Leverage Missouri’s rapid rise to the fifth-largest adult-use market within two years of launch.

- Use the low tax rate (6% state + up to 3% local) to position a strong value advantage.

- Target cross-border demand from Kansas, Oklahoma, Arkansas, and other nearby states.

- Merchandise around core preferences: flower (~50% of sales), pre-rolls, and edibles.

- Partner with brands like STIIIZY, Wyld, and Jeeter while loyalty is still fluid.

- Take advantage of the state's relatively flexible advertising rules .

- Integrate Metrc with your POS for real-time inventory, promotions, and compliance.

- Prioritize local SEO and geotargeted ads to capture both locals and border shoppers.

- Build loyalty programs that turn first-time visitors into repeat customers.

Understanding the Missouri Cannabis Marketing Landscape

Working Within Missouri's Regulatory Framework

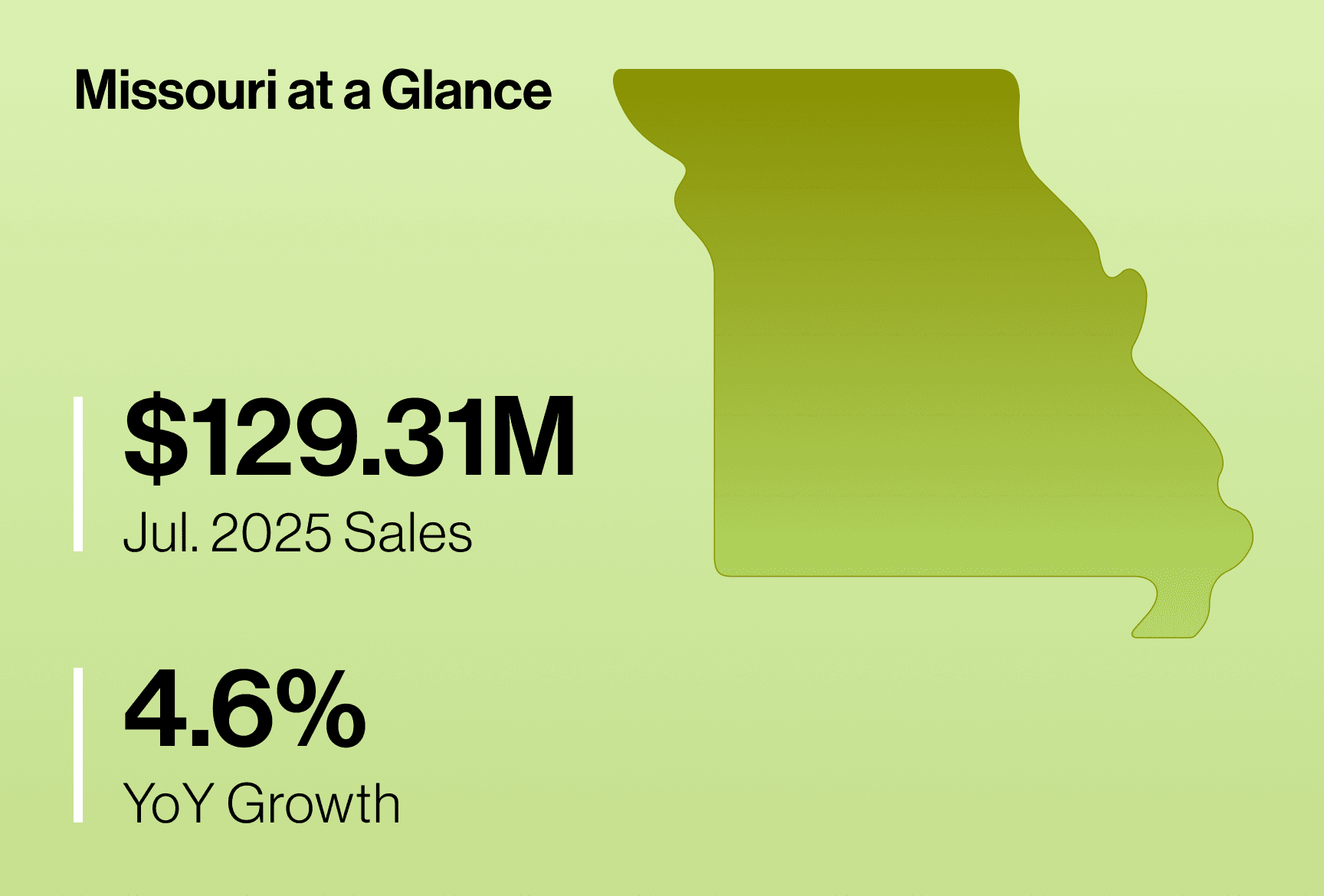

When voters passed Amendment 3 in November 2022, they set the stage for one of the fastest and most successful cannabis market launches in U.S. history. Adult-use sales began in February 2023, and within two years, Missouri had become the fifth-largest recreational market in the country.

Unlike states that flooded the market with licenses, Missouri approved around 350 licenses total, with just over 200 active dispensaries by early 2025. This keeps competition challenging but sustainable, avoiding the oversaturation and price collapse in Oregon and California.

The playing field rewards marketing sophistication and operational excellence for operators, not being a vertically integrated, deep-pocketed MSO.

Advertising Rules That Give You More Room to Work

Missouri’s cannabis advertising regulations, outlined in 19 CSR 100-1.100, are less restrictive than those in most legal states. Dispensaries can use cannabis leaf imagery, run broader campaigns, and advertise across more channels, provided they avoid targeting minors, making false health claims, or using restricted medical terms like apothecary or pharmacist.

Most ad types do not have Illinois-style 1,000-foot buffers, and with proper age gating, you can market through billboards, print, social, and digital media.

The main physical restriction is that your interior operations can’t be visible from public spaces, but that doesn’t limit your ability to create bold, brand-forward external campaigns.

Metrc as a Marketing Advantage

Missouri requires all licensed operators to use Metrc for seed-to-sale tracking, with daily reporting and a designated inventory control agent. While compliance can sometimes feel like a burden, fully integrating your seed-to-sale with your POS turns it into a marketing asset. Having access to real-time data enables:

- Accurate online menus that build trust with customers.

- Dynamic promotions based on current stock.

- Category-specific campaigns tied to sell-through goals.

- It also provides full product traceability, a mechanism for providing a quality and safety signal for consumers who want to know where their cannabis comes from.

A Low-Tax Market That Drives Demand

With a 6% state tax and up to 3% local tax, capped by the Missouri Supreme Court, so city and county taxes don’t stack, the state has one of the lowest effective cannabis tax rates in the U.S. This allows operators to communicate these lower prices in marketing, especially when targeting out-of-state visitors from higher-tax markets.

Consumer Trends & Preferences in Missouri

Flower Still Rules the Cart

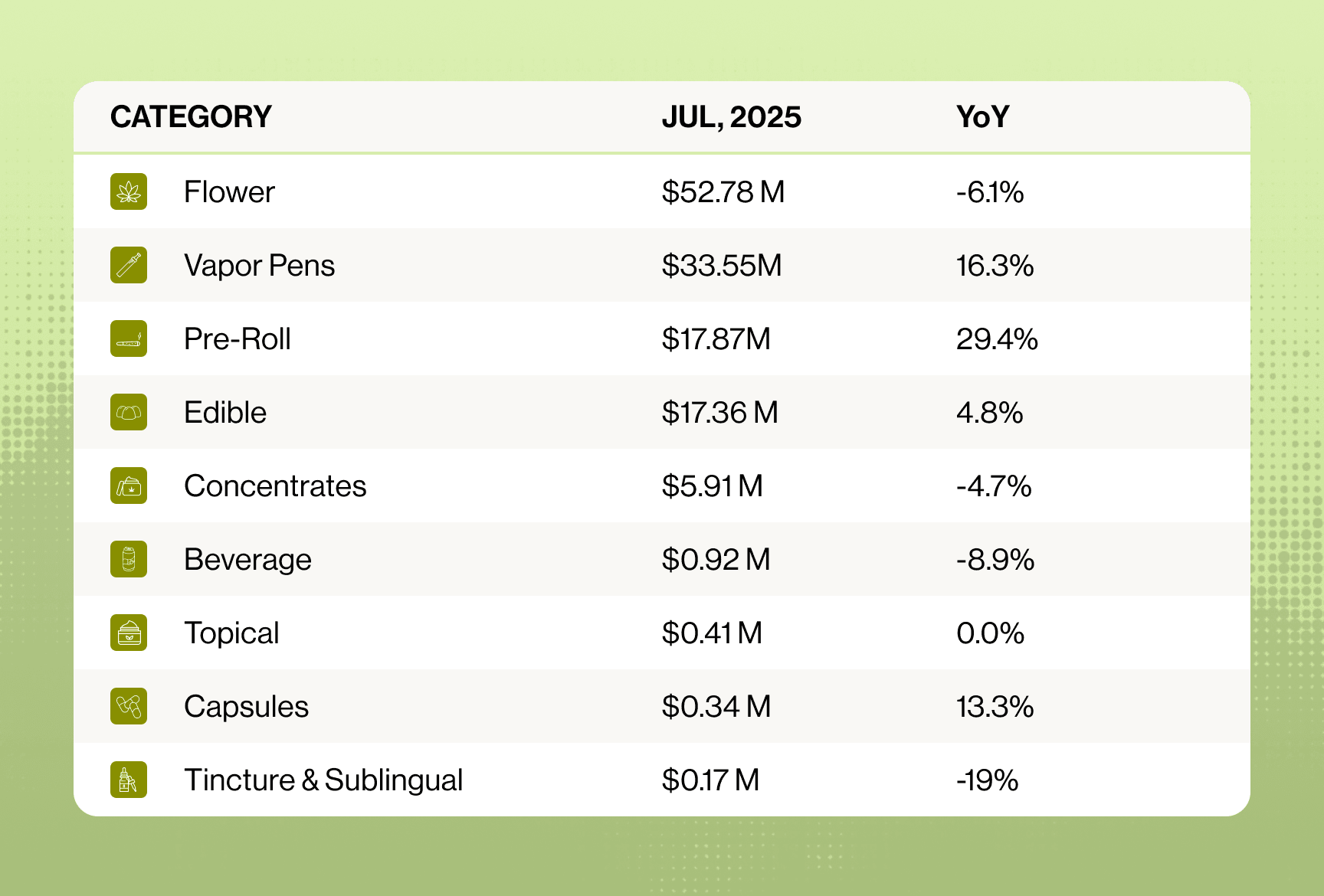

In Missouri, flower accounts for nearly half of all cannabis sales, underscoring the market’s preference for traditional consumption and value-driven purchasing. This share is higher than in many mature markets, where concentrates and edibles have captured higher, relative percentages of the consumer's wallet.

As a dispensary owner, you should evaluate your merchandising decisions based on flowers as an anchor category, the foundation for upselling pre-rolls, edibles, or accessories.

Vaporizers Gain on Convenience

Vaporizers are the state’s second-largest category, reflecting consumer demand for convenience and ready-to-use products. They’re especially popular among newer users and cross-border shoppers who want simple, discreet, portable options. Featuring well-branded vaporizers, cartridge displays, and bundle deals can help drive higher attachment rates for this category.

Edibles & Pre-Rolls Expand Slowly

Edibles and pre-rolls trail behind flower and vaporizers in Missouri, but their share steadily increases as more first-time consumers enter the market. Gummies lead edible sales, appealing to customers looking for a discreet and predictable dosing experience. Pre-rolls attract more experienced consumers and are starting to fill out from a sales perspective, similar to other states.

Cross-Border vs. Local Behavior

Border stores often see 30–40% of transactions from out-of-state customers, particularly from Kansas, Oklahoma, and Arkansas. These shoppers tend to buy in bulk, favor multi-category purchases, and hunt for value, similar to the out-of-state customers Michigan dispensaries see from Indiana, Ohio, and Illinois.

They often stock up on flower and pre-rolls in the same visit. Local customers, in contrast, make smaller, more frequent trips, express greater brand loyalty, and are more open to trying new products.

Brand Loyalty Still Forming

Well-known names like STIIIZY, Wyld, andJeeter have gained early traction, but brand loyalty is still fluid. This creates an opening for dispensaries to influence buying habits through education, in-store promotions, and exclusive partnerships. Missouri-grown brands also benefit from strong support among residents who prioritize local production.

Building Your Missouri Cannabis Marketing Plan

Missouri isn’t just another run-of-the-mill adult-use market; it’s a hybrid of building local loyalty and capturing regional tourism.

Success here requires a dual approach: you’re simultaneously competing for the repeat business of residents and positioning yourself as the go-to destination for out-of-state visitors, much like the strategy we implemented for Positive Energy Dispensary in Ocean City, MD, which faced the same balance of local customer retention and tourist traffic optimization.

This dynamic requires a marketing plan that is flexible, segmented, and laser-focused on these two very different audiences.

Setting Clear Objectives & Dispensary KPIs

Your marketing success depends on tracking the right metrics and understanding how they connect to your bottom line. We developed BNCHMRK, a dataset of key dispensary KPIs, to assist owners, operators, and marketing leaders in better understanding the efficacy of their marketing efforts by looking at a confluence of store-level, order-level, and loyalty-based metrics.

The nine key KPIs connect marketing activities with the income statement and help govern channel-related activity. By leveraging our proprietary BNCHMRK dataset, you can develop an understanding of how various channel-specific KPIs collectively contribute to broader, overall order—and store-level performance.

Before you choose channels or set budgets, define what success looks like in your market.

- Local-focused stores may prioritize retention metrics like loyalty program participation and repeat purchase frequency.

- Border locations might emphasize weekend volume, cross-border conversion rates, and average order size from out-of-state customers.

A clear objective shapes everything else, from your messaging to which channels are selected and budgets are allocated.

Store-Level Metrics

Store-level metrics focus on overall business health and performance:

- Marketing Efficiency Ratio (MER): Measures total revenue generated per marketing dollar spent.

- Acquisition Marketing Efficiency Ratio (aMER): Evaluates revenue specifically attributable to new customer acquisition relative to marketing spend.

Order-Level Metrics

Order-level metrics analyze individual customer transactions:

- Cost Per Order (CPO): Tracks marketing spend efficiency per transaction.

- Customer Return Rate: Highlights the proportion of customers making repeat purchases, indicating marketing's effectiveness in driving ongoing customer engagement.

Loyalty & Retention Metrics

Loyalty-based metrics evaluate customer retention and long-term value:

- Customer Review Rate: Indicates the percentage of customers leaving reviews, reflecting engagement and satisfaction.

- New Customer Review Rate: Specifically measures engagement among new customers.

- Loyalty Program Opt-In Rate: Measures how effectively customers enroll in loyalty programs.

- New Customer Loyalty Opt-In: Evaluates initial engagement by new customers with loyalty programs.

- Marketing Opt-In Rate: Assesses the success of customer consent to marketing communications, highlighting potential for ongoing relationship building.

Budgeting & Resource Allocation

Your marketing budget should reflect your dispensary's business stage, competitive landscape, and specific business objectives. Aligning your marketing spend with clear KPIs ensures efficient resource use and maximum ROI.

Creating Your Dispensary's Marketing Budget

Creating an adequate marketing budget requires assessing three key factors:

- Business Stage: Are you launching, growing, or mature?

- Market Competitiveness: Is your dispensary in a densely competitive urban area or a more rural, less competitive market?

- Revenue Levels: Established dispensaries allocate around 1–2% of topline revenue to marketing. Newer dispensaries or those in competitive markets may need to allocate more.

Allocating Your Budget

Strategically distribute your budget to balance foundational growth with targeted expansion:

Foundational Channels

- Website & SEO (30–40%): Optimize for local searches, ensure intuitive navigation, and prioritize mobile responsiveness.

- Email & SMS Marketing (15–20%): Build an engaged subscriber list to drive repeat visits through personalized communication.

- Local Awareness (15–20%): Invest in local events, promotions, and community engagement.

Growth Channels

- Paid Advertising: Introduce targeted paid search, social media ads, and cannabis-specific platforms incrementally, scaling based on results.

- Loyalty & Retention: Expand loyalty programs, personalized incentives, and referral campaigns for high-ROI customer retention.

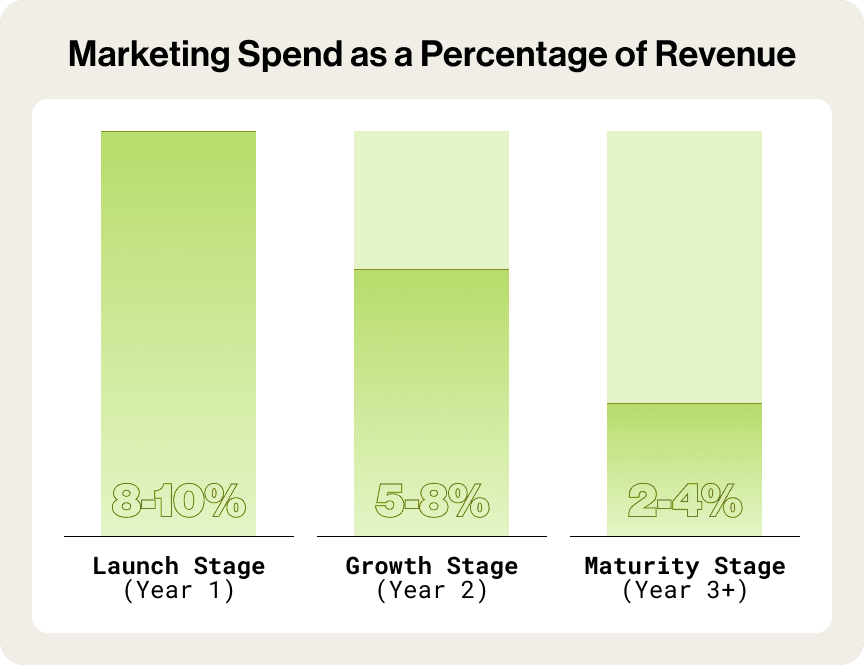

Budget Variations by Stage

Launch Stage (Year 1)

Marketing Spend: 8–10% of revenue

Focus on foundational efforts: website setup, SEO, initial customer acquisition, and establishing local brand presence.

Growth Stage (Year 2)

Marketing Spend: 5–8% of revenue

Expand paid advertising, increase SEO efforts, enhance content creation, and prioritize loyalty and retention programs.

Maturity Stage (Year 3+)

Marketing Spend: 2–4% of revenue

Refine loyalty initiatives, selectively leverage paid advertising, and focus on maximizing customer lifetime value.

Aligning your marketing budget to your dispensary’s lifecycle and market realities ensures sustainable growth, optimized ROI, and lasting success.

Choosing Technology Vendors That Power Marketing Success

The technology supporting your dispensary is your operation’s backbone. Selecting the right online menu & POS system ensures accurate inventory, better customer experiences, and seamless integration with your marketing efforts. In Missouri, where Metrc compliance, cross-border demand, and competitive differentiation are critical, we recommend prioritizing these three integrated components:

Selecting Your Online Menu & POS System

A POS should synchronize real-time inventory across your in-store terminals, website menu, and third-party marketplaces like Weedmaps or Leafly. Accurate product availability prevents “out of stock” disappointments and builds trust that what customers see is genuinely available.

This is even more important in Missouri due to daily Metrc reporting requirements; a modern POS should integrate directly to automate compliance. It should also deliver analytics on purchase history, top-selling SKUs, and peak shopping times (especially tracking weekend vs. weekday patterns for border stores) so you can make smarter merchandising and marketing decisions. As an Agency Plus partner, we recommend Dutchie for its seamless Metrc integration and proven performance in competitive, regulated markets.

Choosing a Cannabis-Focused CRM

Beyond transactions, you need a system that understands Missouri’s unique customer mix: locals making frequent visits and cross-border shoppers making bulk purchases. Implementing a cannabis-focused CRM you can segment by Recency, Frequency, Monetary Value (RFM), product preferences, and geographic origin.

Your CRM should support multi-channel communication, email, SMS, and loyalty platforms, while integrating rewards programs and automated offers that incentivize repeat visits. This is especially valuable for converting first-time border customers into returning buyers and keeping local shoppers loyal in a competitive market.

Integration & Compliance

Choose vendors that work seamlessly together. Real-time sync between your POS, menu, and CRM ensures that promotions reflect current stock, pricing, and compliance status. Built-in compliance features, including Metrc integration, age verification, and Missouri’s tax calculations, reduce admin workload and protect your license.

In a market where accuracy and trust are paramount, especially for customers traveling from out of state, these systems keep your brand consistent across every touchpoint.

Implementing Your Missouri Dispensary Marketing Strategy

Effective dispensary marketing in Missouri means aligning every channel with the state’s dual market dynamic — building brand loyalty with locals while maximizing cross-border traffic from surrounding states. Each channel should be optimized individually and integrated into a cohesive, measurable system.

Website Design & Development – Your Digital Storefront

- Design for both locals and visitors: Your site must speak to repeat customers and first-time cannabis shoppers traveling from Kansas, Oklahoma, or Arkansas. Feature clear location info, border-crossing considerations (if applicable), and easy directions.

- Mobile-first performance: Over 70% of cannabis-related searches in Missouri happen on mobile devices. Pages that load in under 2 seconds convert significantly better than slower sites.

- Real-time menus and education: Sync your POS to display live inventory and pricing and create educational content that helps new customers choose confidently, particularly important for first-time border shoppers.

- Clear calls to action: Drive visitors to join your loyalty program, sign up for SMS deals, or reserve products online.

Local SEO – How Customers Find You

- Capture high-intent searchers: Most consumers who search for a dispensary visit within 24 hours, and the top three organic results get the majority of clicks.

- Fully optimize Google Business Profile: Add accurate hours, categories, photos, and weekly posts. For border locations, include regional keywords like “Missouri dispensary near [City, State] border”.

- Build location-specific content: Blog about local events, cannabis news, or border shopping tips to capture “near me” and long-tail searches.

- Review generation strategy: Aim for consistent, authentic 5-star reviews to improve ranking and build trust.

Email & SMS Marketing – Retaining Local & Border Customers

- Segment by customer type: Send different campaigns to locals (weekly specials, community events) and tourists (bulk discounts, category bundles).

- Automate campaigns: Welcome sequences for new sign-ups, restock alerts, and win-back campaigns generate higher repeat purchase rates.

- Offer exclusives: Use subscriber-only deals and early access to new drops to encourage sign-ups and retention.

- Stay compliant: Use cannabis-friendly CRM platforms like Alpine IQ or Springbig to handle opt-ins, age verification, and Missouri-specific rules.

Paid Advertising – Driving Awareness

- Leverage Missouri’s flexibility: Cannabis imagery is permitted, allowing for more creative visual campaigns.

- Geotarget precisely: For border stores, run ads targeting major population centers in neighboring states within driving distance.

- Multi-channel approach: Combine search ads, programmatic display, and cannabis marketplace placements (Leafly, Weedmaps) with local billboards or event sponsorships.

- Track everything: Use unique URLs, QR codes, and call tracking to measure ROI by campaign and channel.

Missouri Dispensary Marketing FAQs

Can dispensaries advertise in Missouri?

Yes. Missouri’s cannabis advertising laws allow more creative flexibility than many states, including the use of cannabis leaf imagery, multi-channel ad campaigns, and billboard placements — as long as you don’t target minors, make unverified health claims, or use restricted medical terms like apothecary or pharmacist. Interior operations must be obscured from public view, but external marketing can still be bold and brand-forward.

Are dispensaries in Missouri profitable?

Many are — especially those near borders. Missouri’s 6% state tax plus up to 3% local tax is among the lowest in the U.S., and the licensing cap keeps competition manageable. With cross-border shoppers from Kansas, Oklahoma, and Arkansas making up as much as 30–40% of sales at some locations, well-run dispensaries often reach profitability within 12–18 months.

How much does a dispensary owner in Missouri make?

Owner earnings vary by location, efficiency, and marketing effectiveness. Successful stores can generate annual owner income between $200,000 and $600,000, with top border locations exceeding $800,000 thanks to larger transaction sizes and weekend volume spikes.

Working With Cannabis Marketing Professionals

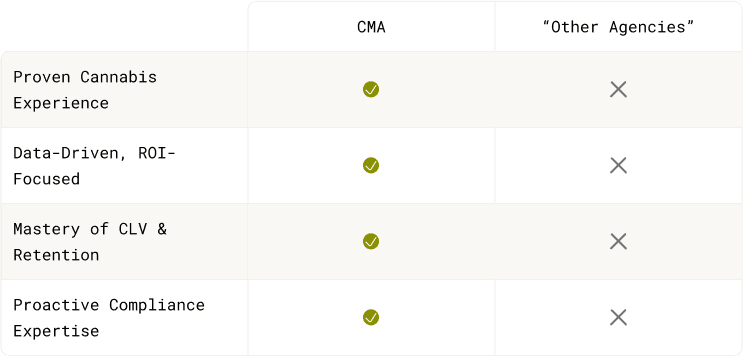

Missouri’s cannabis market is in a league of its own. It has rapid growth, strong cross-border demand, and a competitive but manageable licensing environment. These factors create opportunities but also require marketing expertise that goes beyond what most general agencies can offer.

If you decide to work with a Missouri Cannabis Marketing Agency, here are a few things to remember.

Prioritize Missouri-specific cannabis marketing experience.

Choose a partner who understands the nuances of Missouri’s cannabis market: how the licensing cap shapes competition, how border traffic changes demand patterns, and how to balance value messaging with premium positioning. Ask for case studies from similar emerging markets — ideally with data from Missouri.

Demand data-driven strategies with local benchmarks.

A capable cannabis agency will measure success with Missouri-relevant metrics like Border Traffic Ratio, weekend vs. weekday MER, and loyalty program participation rates segmented by local vs. tourist shoppers. Avoid agencies that rely solely on national benchmarks, as they won’t capture the realities of Missouri’s mixed customer base.

Ensure your partner has compliance expertise.

Missouri’s ad rules are more flexible than many states, but everyone must follow an established set of rules. Your agency should have systems to prevent violations before they happen.

Look for cultural and community alignment.

In Missouri, success is built on authenticity. Whether your market is a tight-knit rural community, a busy urban center, or a border location serving multiple states, your marketing partner should understand how to connect with that audience in a way that feels real.

Moving Forward with Marketing Your Missouri Dispensary

Missouri is one of the most promising cannabis markets in the country, but opportunity alone doesn’t guarantee success. Long-term growth comes from combining strategic vision with consistent, disciplined execution.

Start with the fundamentals.

Your foundation is clear objectives, a tech stack integrating POS, CRM, and inventory, and a multi-channel marketing plan tailored to locals and visitors. Perfect plans aren’t necessary — but consistency is.

Identify your primary growth lever.

- Border dispensaries: Optimize for weekend spikes, larger basket sizes, and bulk promotions.

- Urban dispensaries: Focus on loyalty programs, consistent daily traffic, and neighborhood brand presence.

Build for flexibility.

Regulations, competitors, and consumer preferences will continue to evolve. The dispensaries that win will have systems, not just campaigns, that adapt quickly without losing focus on measurable results.

Missouri rewards action over theory.

The operators who move beyond planning and commit to steady, data-driven marketing execution will lead the market in the years ahead.

About The Cannabis Marketing Agency

The Cannabis Marketing Agency: Cannabis marketing experts making your dispensary the one everyone talks about (in a good way).

We make your dispensary the local favorite — the spot people talk about, shop at, and keep coming back to.

+4 Years Growing Dispensaries: We don't "learn on your dime".

Trusted by Dispensaries in 18 Markets: From Cali to Mass, if it’s legal, we’ll help you win.

For DIYers who hate learning the hard way.

Want More Dispensary Customers?

We grow dispensaries like it’s our day job (because it is). Ever wonder what we’d do for yours? Let’s find out.

Get Started